Are international equities overvalued

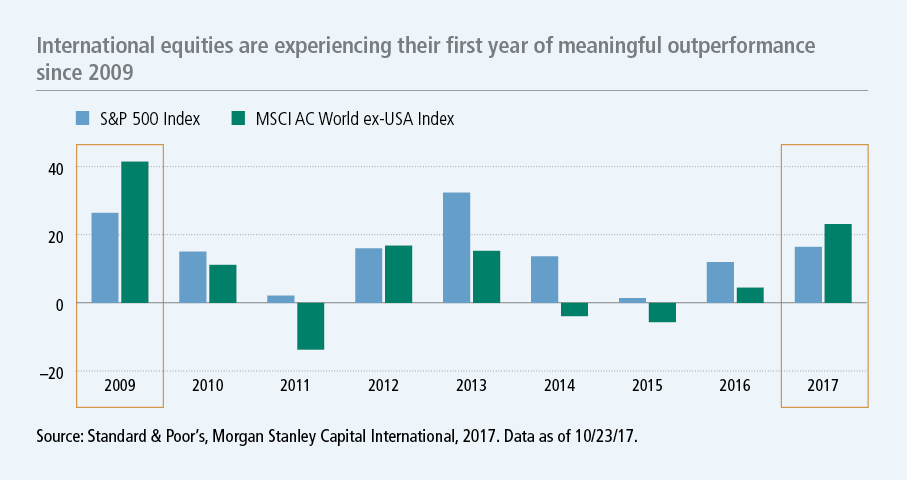

International stocks are on pace to outperform their U.S. counterparts in 2017—their first year of meaningful outperformance in nearly a decade. In emerging markets, the performance differential is significant.

Several asset managers in our network have made the case for international investing in these pages, highlighting compelling valuations, select sectors, and smaller-cap opportunities, as well as the potential durability of the turnaround. Yet a common concern I hear from financial advisors is that the entry point for adding international equity exposure may have already come and gone. We believe the evidence says otherwise.

Stronger earnings are keeping international equity valuations in check

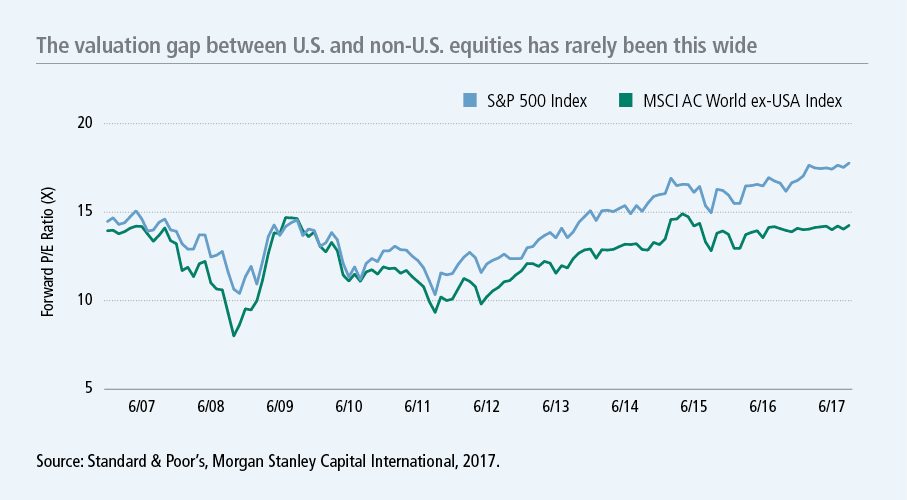

Despite the rally, international stocks have become cheaper relative to U.S. stocks this year as a result of rapidly strengthening corporate fundamentals in those markets. The managers in our network who favor international equities based on valuations have not only maintained their conviction, but generally believe that international equity valuations are more attractive today on a relative basis than they were at the start of the year.

Lower valuations on international stocks are nothing new. Over the past 10 years, the MSCI All Country World ex-U.S. Index has traded at a roughly 13% discount to the S&P 500 Index on a forward price-to-earnings (P/E) basis. However, today they trade at a 25% discount on average. The magnitude of this valuation dispersion is rare, occurring in fewer than 5% of monthly periods since September 2007.[1]

The fact that international equities are becoming relatively cheaper during a period of outperformance is owing to two factors, according to the portfolio teams we spoke with: First, underlying corporate fundamentals in non-U.S. markets are accelerating at the same clip as stock prices. In the current edition of Market Intelligence, we note that most MSCI EAFE Index sectors are expected to generate double-digit earnings growth this year. Yet, as shown in the chart above, the forward multiple for international equities has barely budged over the course of 2017. Second, U.S. equity multiples have expanded at a faster rate than underlying fundamentals this year, as investors have placed a higher value on domestic earnings growth. U.S. valuations have been ticking higher as a result.

The managers in our network also point out that this valuation divergence is not limited to select sectors but is broad based, with 8 of 11 international sectors trading at a discount to their U.S. counterparts.

We agree with the consensus view that investors should consider overweighting non-U.S. equities in a global balanced portfolio. Improving corporate fundamentals and attractive valuations are increasingly potential tailwinds, while populist politics have started to fade in Europe. We see no reason to believe that the time to add such exposure has passed.

Important disclosures

Important disclosures

1. FactSet, 2017.

The forward price-to-earnings (P/E) ratio is a stock valuation measure comparing the current share price of a stock with the underlying company’s estimated earnings per share over the next 12 months.

The MSCI ACWI ex USA Index tracks the performance of large- and mid-cap representation across 22 of 23 developed-market countries (excluding the US) and 24 emerging-markets countries. The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. It is not possible to invest directly in an index

Investing involves risks, including the potential loss of principal. There is no guarantee that a fund’s investment strategy will be successful. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Value stocks may decline in price. Hedging and other strategic transactions may increase volatility and result in losses if not successful. Large company stocks could fall out of favor, and illiquid securities may be difficult to sell at a price approximating their value. The stock prices of small and midsize companies can change more frequently and dramatically than those of large companies. The fund may invest its assets in a small number of issuers. Performance could suffer significantly from adverse events affecting these issuers.

MF409652