Practice Management Network

A suite of resources designed to help you meet your clients' evolving needs while taking your business to the next level

Building better outcomes to help take your practice to the next level

From market analysis to behavioral finance to portfolio construction, our goal is to help you build better outcomes for your clients.

| CE approved | Supporting material | ||

|---|---|---|---|

|

Market IntelligenceOur dedicated in-house research team aggregates, analyzes, and evaluates that market analysis to develop our 12- to 18-month outlook on a range of asset classes. The result is Market Intelligence.

|

||

|

|

Decision economics: a behaviorally informed framework for investment decision-makingExplores decision economics, a behaviorally informed framework for making investment decisions. Discusses five key areas of the investment decision-making process in depth and offers fiduciary best practices for counteracting behavioral tendencies.

|

||

|

Dispelling common myths of model portfoliosThere are perceptions about model portfolios that have developed over recent years that have kept some advisors from seriously considering them for their clients. In this presentation we examine common myths of model portfolios and seek to overcome resistance, while weaving in the potential benefits for your clients and your practice.

|

||

|

History lessonsIf you ask what the markets are going to do, the answer would be that they are going to fluctuate! Volatility can feel like the ups and downs of a rollercoaster. While we know that past performance is not indicative of future results, when it comes to behavior of markets, patterns often repeat themselves. Circumstances may change but patterns rarely do. History lessons is a walk down memory lane to see where we have been and a peek around the corner to see where we may be going.

|

Creating a sustainable practice

Resources to help you build, grow, and manage your practice.

| CE approved | Supporting material | ||

|---|---|---|---|

|

Communicating your value: differentiating your brand for client acquisition and retentionThis module is designed to educate financial professionals on how to turn your competitive strengths into simplified messages that will help you retain exisiting clients and compel prospective clients to take action. In addition to providing insight into your value statement(s) and standard of care, it offers a unique approach to developing process in your practice which helps create efficiency and communicates to clients the experience they can expect and the value you deliver. We also discuss how to amplify one's brand and how to confidently communicate fees in a transparent way that helps prospective clients connect the standard of care they can expect and the fees that you charge.

|

||

|

The changing fee landscapeThe changing fee landscape provides a detailed look at current research on fee trends. We review the financial planning approaches and fee models of highly-successful advisors who provide comprehensive financial planning as a core client deliverable. Advisors receive a comprehensive view of the prevailing financial planning fee models: AUM offset, flat fees, hourly fees, subscription fees, and hybrids. Advisors will be armed with the knowledge of the mechanics and trade-offs for various financial planning fee models so that they may adopt the approach or approaches that best suit their practice, clients, and prospects.

|

||

|

Amplify your brand: master your digital presenceThis series of presentations, videos, checklists and flyers on seven different digital marketing topics will help you take your digital marketing presence to the next level. From search engine optimization (SEO) and content strategy to local SEO, blogging and webinars, paid media marketing, word of mouth referrals, holistic marketing strategies and compliance and regulatory guidelines; we provide detailed resources to help you extend your reach and drive client acquisition.

|

||

|

Expanding your client connectionsProposes new ways to refine your outreach strategy to clients 12 months a year by showing cause-oriented dates for your calendar. Provides innovative event planning ideas and tips to help you connect in person with existing and prospective clients.

|

Discover new ways to expand your wealth planning expertise

When it comes to navigating complex wealth management issues, we have resources to help keep your skills up to date. Plus these presentations may help you earn continuing education credit.

| CE approved | Supporting material | ||

|---|---|---|---|

|

Empowering business owner conversations: becoming the business owner's most valued advisorWorking with business owners can be challenging and yet very lucrative. This is a space that is ripe with opportunity but how do you embed yourself with business owners so that you're a trusted team member when the liquidity event occurs?

|

||

|

Women, wealth and wisdom: engaging your female clients and prospectsThis is not the typical Women & Investing seminar you may have seen in the past. And, it is not investment education! Instead, it focuses on financial planning issues that people face at various stages of life. We accomplish that by offering 9 robust case studies which will each have at least one correlated checklist/worksheet/primer.

|

||

|

Understanding Social Security decisions: optimizing your benefitsCovers the basics of Social Security, how to incorporate it into client portfolios, and strategies for maximizing this benefit to supplement other sources of retirement savings.

|

||

|

Understanding Medicare: the ins and outs of Medicare coverageLearn how to help your clients plan for Medicare decisions by understanding the history of Medicare, the parts of Medicate and how they work, enrollment rules, and the costs associated with Medicare. Also discussed are Medigap plans, Medicare Advantage plans (Part C), and what your clients need to consider if they plan on working past 65.

|

||

|

Generational intelligence: family communication and wealth transfer planningThis presentation is designed to help you develop specific strategies for retaining and growing client assets as they transfer from one generation to the next. It highlights generational differences in communication and provides strategies for improving family communication in order to enable successful wealth transfer and help preserve family harmony.

|

||

|

Advanced college savings conceptsSaving for college is often one of life’s biggest financial goals—and it can be complicated. “Advanced college savings concepts” explains the differences between 529 plans and other college savings vehicles and explores key related issues, including financial aid and estate planning.

|

||

|

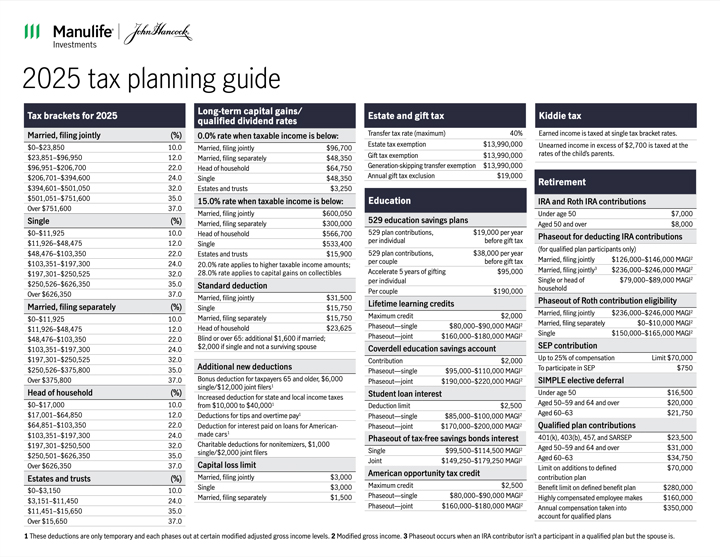

Tax planning guidesEasily access the latest tax information by using our tax planning guide. To get answers quickly, the sections on the front are divided into tax brackets, long-term capital gains/qualified dividend rates, and more. The back provides additional information on required minimum distributions and uniform lifetime tables.

|

Enhance the experience you deliver to your clients with our investor seminars

A well-educated client is often the best client. Our series of investor seminars will equip your clients with everything they need to know on a range of topics, from saving for college to drawing on Social Security.

| CE approved | Supporting material | ||

|---|---|---|---|

|

Women, wealth and wisdom: case studies, worksheets and checklists to empower your journeyThis is not the typical Women & Investing seminar you may have seen in the past. And, it is not investment education! Instead, it focuses on financial planning issues that we all face at various stages of life. We accomplish that by offering 9 robust case studies which will each have at least one correlated detailed checklist/worksheet/primer.

|

||

|

History lessonsIf you ask what the markets are going to do, the answer would be that they are going to fluctuate! Volatility can feel like the ups and downs of a rollercoaster. While we know that past performance is not indicative of future results, when it comes to behavior of markets, patterns often repeat themselves. Circumstances may change but patterns rarely do. History lessons is a walk down memory lane to see where we have been and a peek around the corner to see where we may be going.

|

||

|

Understanding Medicare: the ins and outs of Medicare CoverageLearn how to plan for Medicare decisions by understanding the history of Medicare, the parts of Medicare and how they work, enrollment rules, and the costs associated with Medicare. Also discussed are Medigap plans, Medicare Advantage plans (Part C), and what you need to consider if you plan on working past 65.

|

||

|

Understanding Social Security decisions: optimizing your benefitsCovers the basics of Social Security, how to incorporate it into your portfolio, and strategies for maximizing this benefit to supplement other sources of retirement savings.

|

||

|

My brain made me do it: strategies to help you make better decisionsAddresses investor biases and offers suggestions on how to avoid six common investor mistakes, including anchoring, procrastination, and paralysis by analysis.

|

||

|

10 things every investor should know about investingCovers time-tested investment principles to help you educate investors as they strive to reach their financial goals. Includes tips on asset allocation, the importance of time in the market, and more.

|

Learn more

Financial professionals: Ask a Manulife John Hancock Investments Business Consultant for a review of how our practice management materials can help you build your business.

Request a meeting with a Manulife John Hancock Investments business consultant

* indicates a required field

Thank you

Your submission was successful