Three alternative asset classes worth watching right now

Choosing the best-performing alternative investments—like choosing the top traditional asset classes—can be done consistently only in retrospect. That’s reason enough to avoid too much concentration in any single category. Instead, we favor a multistrategy approach to alternative assets.

Some types of alternatives tend to perform better than others during certain phases of the business cycle. Having a variety of exposures may help provide a more meaningful measure of stability as macroeconomic conditions change, sometimes without warning. In particular, three alternative types—buy-write (or options-based) funds, long/short equity, and active foreign exchange (or currency)—may merit special consideration as you contemplate portfolio construction adjustments for the current market environment.

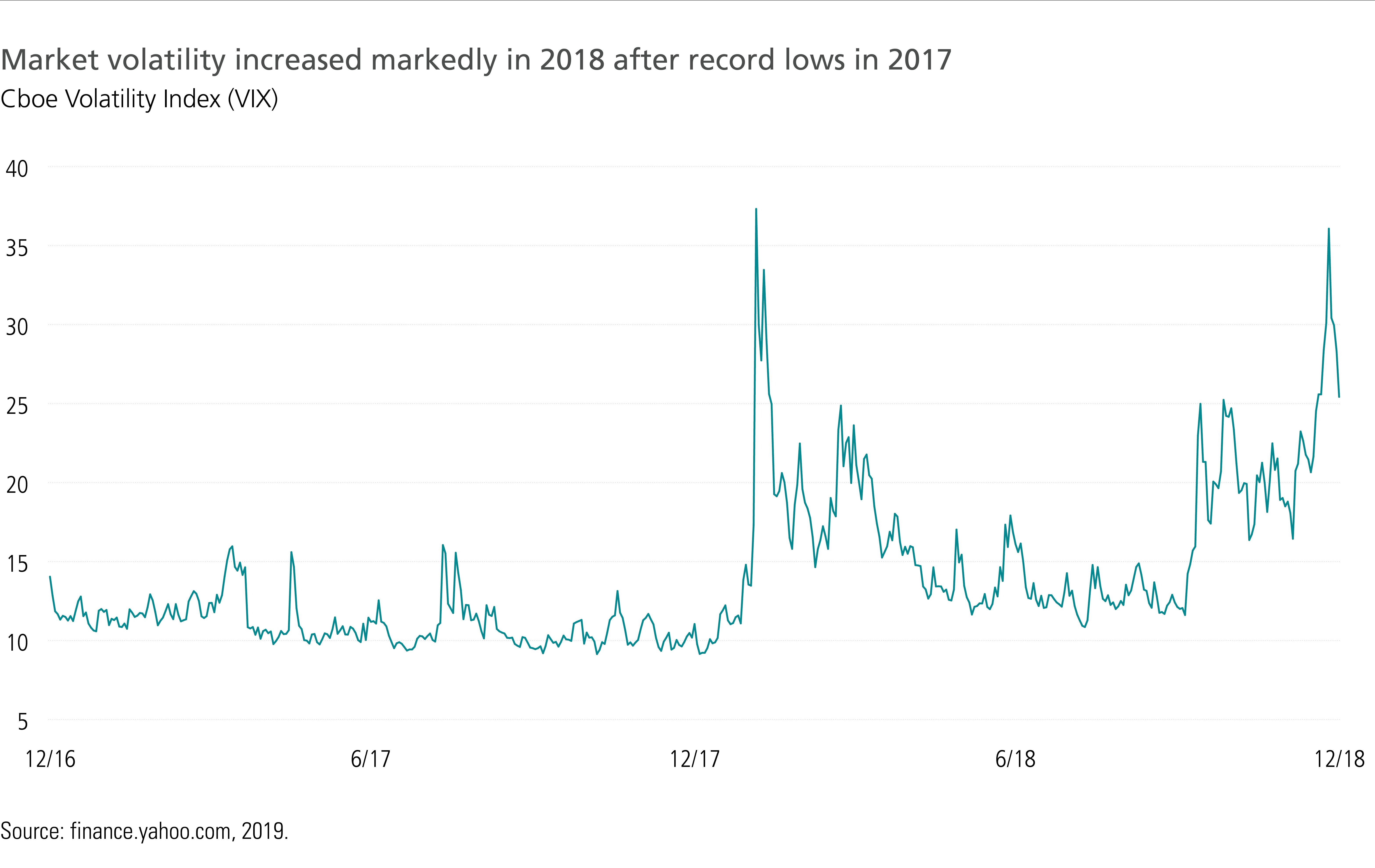

1 Options-based funds to counterbalance higher market volatility

Near the end of economic expansions, market volatility typically rises, and that’s exactly what we’ve seen over the last year or so. After hitting single-digit lows in 2017, the Cboe Volatility Index, or VIX, rose fourfold in the opening weeks of 2018, spiking yet again as the year drew to a close. Rising volatility tends to coincide with falling stocks, but alert and prepared investors may actually benefit from these choppy markets. Take volatility harvesting funds, for example. Such funds can pursue capital appreciation through covered call positions—buying equities and selling call options on those equities. A fund employing covered calls forfeits some degree of upside, since a stock can be called away if and when it rises above the strike price, but the fund also gets to pocket incremental income—the premium collected from selling the call option—no matter what happens with the price of the underlying stock. Since option prices tend to rise along with market volatility, the more erratic the market behaves, the better such opportunities become.

2 Long/short equity to bolster defensive characteristics

Market return expectations tend to become lower as economic expansions mature, and long/short equity strategies offer investors something long-only mandates can’t: potential downside protection. A long/short fund has the opportunity to generate returns in three ways. First, like any equity fund, it can add value through the selection of long stock positions. Second, it can tactically hedge its net exposure, or beta, by taking short positions in the market. Third, a long/short fund can potentially add value by choosing which particular equity segments to sell short if the manager expects those assets to decline or underperform the market. The key to success is nimbleness. The best long/short managers have the ability to dial net exposure up or down while also maintaining exposure to promising ideas on both the long and short sides. This can be a distinct advantage as intramarket correlations fall and investors begin to focus more on company-specific fundamentals when a macroeconomic tide of liquidity is less likely to lift all boats.

3 Active currency to diversify stock and bond exposure

Stocks and bonds tend to dominate most portfolios, and 2018 reminded investors why it can be helpful to maintain an allocation to something other than stocks and bonds. Active absolute return currency approaches may be able to help you build a more resilient portfolio, especially when the outlook dims for mainstream asset classes. Such funds that make tactical currency allocations assume no direct equity risk and virtually no credit risk. Rather than relying on generally rising capital markets, active currency managers can seek returns by working to identify relative value discrepancies. Buying (going long) one currency requires selling (going short) another currency. As a result, active currency strategies offer investors the potential for positive performance precisely when the opportunities elsewhere are scarce.

Blending different alternative assets balances their distinctive traits

By reviewing the properties of options-based strategies, long/short equity, and active currency, it’s clear that alternative investments can be as different from one another as they are from the broader market itself. What could be better than introducing any one of these diversifying approaches into your portfolio? You can consider combining some of each, either through a bundle of discrete allocations or as part of an integrated one-stop solution. Certain multi-alternative approaches, for example, combine the three approaches we’ve covered here, along with other unconventional assets, such as infrastructure, managed futures, and merger arbitrage. While alternatives cover a wide variety of different strategies, they share an ability to pursue return sources uncorrelated with the mainstream market risks driving most investors’ portfolios today.

Important disclosures

Important disclosures

The views expressed are those of the author(s) and are subject to change. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index.

Investing involves risks, including the potential loss of principal. A portfolio concentrated in one sector or that holds a limited number of securities may fluctuate more than a diversified portfolio.

MF725594