November 11, 2025

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

Enter your password to login.

To verify your identity, we need to send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

Please try again later.

We need a phone number to keep your account secure. We will send you a code to validate your phone number.

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

We have sent an email to {0}. Click the link in the email to finish setting up your dashboard

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

Asset allocation model portfolios are a great way to get diversified exposure to financial markets in a single step. Explore this site to learn more about the benefits of model portfolios and our range of options.

Demand for customization and personalization drive growth in model portfolios.

Unlike asset allocation model portfolios that provide broad exposure across multiple asset classes, building block model portfolios focus on one specific asset class, such as fixed income, U.S. equity, or international equity. We consider some of the benefits of using building block model portfolios.

Targeting specific investment outcomes using a range of asset classes, management strategies, and investment styles

John Hancock Multi-Asset Income Model Portfolios

Options in the search for yield

Portfolios targeting the highest potential returns within defined risk parameters

John Hancock Target Risk Model Portfolios

Options for investors seeking a relatively stable balance of risk/return potential over time

Portfolios offering diversified single asset class exposures

John Hancock Building Block Model Portfolios

Options for investors seeking a comprehensive investment option for single asset class equity or fixed income exposure

Our multi-asset investment process is centered on investors’ risk parameters and return objectives. The key objective is to maximize returns for any given level of risk, which relies on robust asset class analysis and skilled portfolio construction.

Macro inputs are combined with fixed-income, equity, and alternative asset class forecasts that consider growth expectations, valuation changes, currency returns, and income return among other analyses.

Asset class and strategy selection is aligned to investors’ risk/return objectives. Asset class analysis is model driven, using both quantitative and fundamental inputs.

Optimal portfolio construction is based on rigorous ongoing ex-ante analysis and ex-post analysis and return forecasts. Risk management is embedded in every step of the process with ongoing monitoring and evaluation.

Every quarter, the Multi-Asset Solutions Team compiles an analysis of anticipated performance for different asset classes over a 5-year and long term (20-year plus) time horizon. These views guide the team's asset allocation decisions across a range of portfolios and investment strategies.

Multi-Asset Solutions Team:

56 investment professionals

32 CFA charterholders

Manager research team:

24 investment professionals

18 CFA charterholders

Source: Multi-Asset Solutions team, Manager research team, as of 12/31/25.

All logos are the property of their respective owners.

Representative example is for illustrative purposes only.

1988

Firm introduces multimanager approach to investing

1995

Multimanager asset allocation portfolios for retirement plans

2005

Target-risk portfolios for individuals

2009

Alternative Asset Allocation Fund

2011

Asset allocation model portfolios

2016

U.S. sector rotation portfolios

2019

Over $100B in multi-asset portfolios under management

Models can enable financial professionals to spend more time with their current clients on holistic wealth and financial planning and less time on investment research, portfolio construction, rebalancing, trading, and fund rationalization.

Leveraging models may also lead to more efficient integration of new client relationships, as clients with similar risk profiles elect the same models, enabling financial professionals to spend more time converting prospects into clients.

Models enjoy the benefits of asset allocation and manager selection from an experienced third party with a robust process and a documented rationale for key investment decisions. They also enable financial professionals to leverage manager investment commentary and other materials.

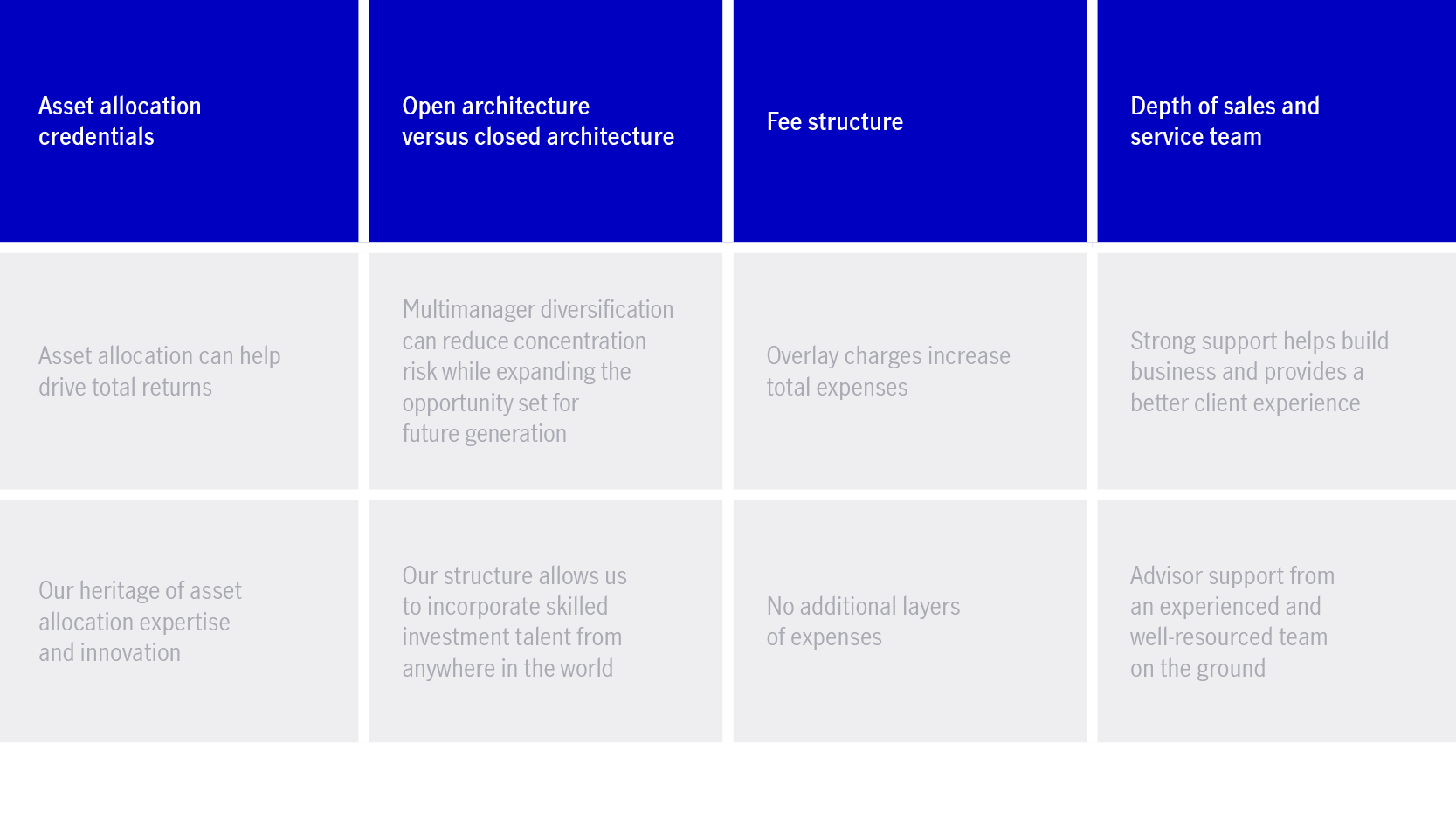

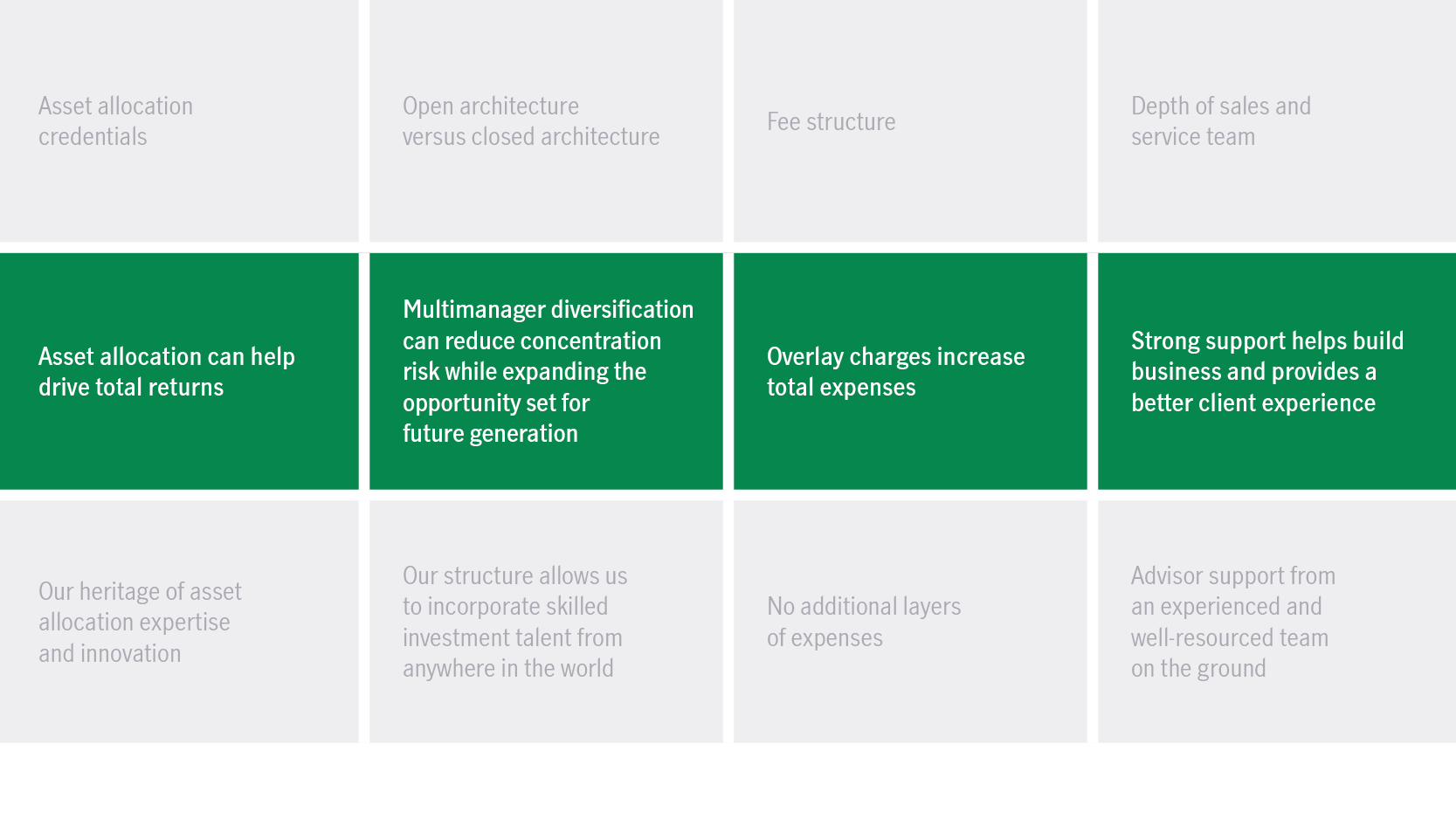

Scale, experience, and fee structures can vary widely across the industry.

Diversification does not guarantee a profit or eliminate the risk of a loss.

In this episode, Katie Baker, senior national account manager and model delivery lead at Manulife John Hancock Investments, and Bruce Picard, CFA, portfolio manager and head of model portfolios at Manulife Investment Management, discuss potential opportunities in model portfolios.

November 11, 2025

June 16, 2025

November 20, 2025

This guide offers reasons for financial professionals to consider model portfolios, key factors to consider when evaluating providers, and our investment approach.

Financial professionals: Learn more about reasons to consider model portfolios, key factors to consider when evaluating providers, and our approach.

Investors: Ask your financial professional how model portfolios can help you achieve your long-term investing goals.

Request a meeting with a Manulife John Hancock Investments business consultant

* indicates a required field

Thank you

Your submission was successful