September market recap: Fed kicks the can to December

September provided a mixed backdrop for capital markets; risk assets continued to push higher while the defensive, low volatility segments came under pressure.

Emerging-market equities led global stocks up 1.3%, small-cap U.S. stocks rose 1.1%, and high-yield bonds gained 0.7% for the month. Traditionally more defensive consumer staples stocks declined 1.5%, telecom stocks fell 0.9%, and investment-grade corporate bonds were down 0.3%.1

Three themes held sway in September:

The Fed remained on hold

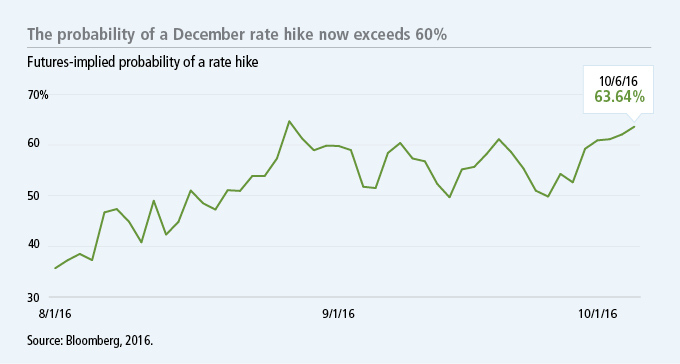

While the tone of Chair Janet Yellen's testimony was generally perceived as hawkish, preparing the markets for a potential December rate hike, the Federal Open Market Committee lowered its fed funds forecasts for 2017 and beyond. This signal was generally viewed as positive for risk assets in the near term; the U.S. dollar weakened, propping up foreign currencies; emerging-market equities rallied; and more defensive duration-sensitive assets experienced selling pressure across both stocks and bonds. It remains to be seen how markets will react to an actual Fed hike should it comes to pass in December.

OPEC set the stage for a potential output freeze

With oil supplies still elevated and prices below what many OPEC members would like, news of a plan to put a target cap on production emerged from OPEC's late September meeting in Algeria. The actual targets and levels of production are expectedto be formalized in November. Oil prices gained 6.5% for the month, with prices on West Texas Intermediate climbing to just under $50 a barrel. In fact, energy was the best-performing sector in the U.S. stock market, up 3.1% for the month.1

Energy sector strength has broader implications for corporate fundamentals, which have suffered from an energy-driven earnings decline over the past two years. Any earnings rebound in the sector could improve the overall U.S. earnings picture and decrease price-to-earnings multiples as a result.

Geopolitical risks appeared to subside, but remain a potential threat

The first U.S. presidential debate was held in late September, and stocks rallied the day after. With four weeks to go before the election, markets appear to be pricing in more of the same in the White House. Internationally, we received two major clues in September about potential geopolitical developments in Europe. An Italian referendum has been scheduled for December 4, the outcome of which could have major ramifications for current Prime Minister Matteo Renzi as he has communicated that he intends to step down if the referendum is not passed. A change in leadership in Italy could clear the path for a more anti-European Union agenda. In the United Kingdom, it's been business as usual post-Brexit, but newly appointed Prime Minister Theresa May announced that formal Brexit negotiations would likely begin in March 2017, setting up the potential for another bout of global market volatility. Indeed, the lack of volatility witnessed during September suggests that markets may have become overly complacent, given the extent of geopolitical uncertainty in the world. The CBOE Volatility Index rose to 18 prior to the Fed meeting but ended September at a more mild 14.

Taken together, these themes help explain the strong run in risk assets so far in 2016. Emerging markets have now climbed 16.0% for the year to date, while high-yield bonds and small-cap U.S. stocks have risen 15.1% and 11.5%, respectively.1 Our network of asset managers and research firms believes that some of these asset classes may have become stretched from a valuations perspective (e.g., high-yield bonds), while others, including emerging-market equities, have potential for further upside.

1 Emerging-market equities, high-yield bonds, and U.S. small-cap stocks are represented by the MSCI Emerging Markets Index, which tracks the performance of publicly traded large- and mid-cap emerging-market stocks; the Bloomberg Barclays U.S. Corporate High Yield Index, which tracks the performance of U.S. dollar denominated, high-yield, fixed-rate corporate bonds; and the Russell 2000 Index, which tracks the performance of 2,000 publicly traded small-cap companies in the United States, respectively. Energy sector performance is represented by the energy sector component of the S&P 500 Index, which tracks the performance of 500 of the largest publicly traded companies in the United States. The Chicago Board of Options Exchange (CBOE) Volatility Index (VIX) shows the market's expectations of 30-day volatility and is constructed using the implied volatilities of a wide range of S&P 500 Index options. It is not possible to invest directly in an index.

Important disclosures

Important disclosures

Price-to-earnings ratio is a valuation measure comparing the current share price of a stock to the underlying company's earnings. West Texas Intermediate is a grade of crude oil used as a benchmark for oil pricing.

All investments involve risks, including the potentialloss of principal. Stocks can decline due to adverse issuer, market, regulatory, or economic developments, and the securities of small companies are subject to higher volatility than those of larger, more established companies. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability.

MF322934