Secular stagnation-not dead yet

Several weeks into the new U.S. presidency, we have a slightly better idea about where the White House's policy priorities lie than we did at the end of 2016.

However, a number of uncertainties remain, including how the government's initiatives might be financed, which proposals will win enough legislative support to stay viable, and, ultimately, when any bills that go the distance actually become enacted into law.

The United States hardly has a monopoly on uncertainty though. In Europe, political uncertainty continues to pose the greatest risk to the economic recovery there. With the United Kingdom's triggering of Article 50 on March 29 and a busy upcoming election schedule in the eurozone, economic growth in the region could face headwinds for some time to come.

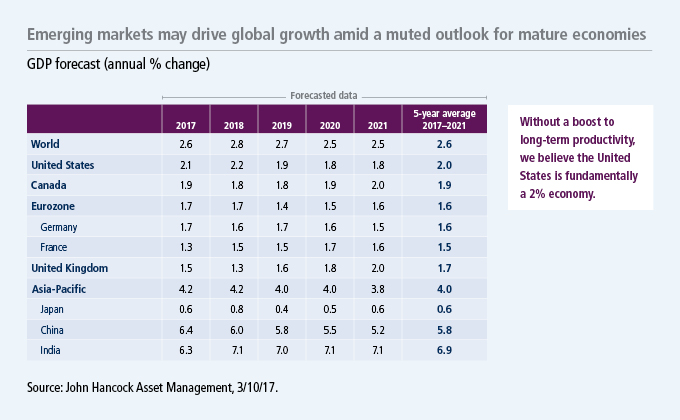

Investors have become more bullish about growth, inflation, and interest-rate projections for the United States and Europe, suggesting that the lower-for-longer era is drawing to a close. In our view, a moderate uptick in these indicators is indeed likely; however, in the absence of a fundamental boost to long-term productivity, any quick hit economic stimulus measures will probably fizzle out. While investors seem to have the direction of the movement of these indicators correct, we think the magnitude and timing of any improvement is going to be more disappointing than the consensus expects.

In the United States, we expect policy implementation challenges on multiple fronts

With more than two months under its belt, the new administration is starting to convey more clarity to its policy priorities. Repealing and replacing the Affordable Care Act (ACA) was a high priority, in part for the savings it was meant to generate in order to finance other government initiatives. However, with its inability to repeal or replace the ACA-so far-the government seems to have set its most immediate sights on tax reform instead. The aim is to legislate tax reform by the end of the summer, but we view this as an unrealistic timetable. Just as there were deep divisions within the Republican party over healthcare, there will also be fierce debate concerning tax reform, and the fault lines within the Republican party on both issues are roughly the same.

The new government has also aimed to repeal some of the regulation put in place following the global financial crisis. This could represent a quick win for the Republican party, boosting equity markets and economic growth as the energy and financial services sectors return to greater profitability. President Trump has already signed an executive order requiring the elimination of two old regulations for every new one signed. This should help on the margin, but more significant deregulation involves repealing parts of Dodd-Frank, a more controversial undertaking even within Republican circles. If broad consensus can't be reached this year, any Dodd-Frank dismantling will likely be delayed until 2019, as Senate elections in 2018 are bound to make passing legislation more difficult. In our view, significant deregulation may be postponed indefinitely, a risk currently underestimated by the markets.

In terms of the U.S. government's two primary spending priorities, the immediate focus switches back and forth between defense and infrastructure spending. Infrastructure spending may be tied to tax reform as a carrot to entice Democrats' support for the latter. Even if infrastructure projects are legislated and implemented before defense spending, there is an extensive lag time between the initiation of tender offers for infrastructure spending projects and the point in which those projects actually become shovel ready. By the time any infrastructure spending finds its way into the real economy, President Trump's first term in office may well be over.

In our view, there are few aspects of the government's spending plans that would boost long-term productivity or enduring economic growth. Infrastructure projects devoted to improving education and training-such as building schools-could achieve this. Unfortunately, these types of projects tend to have unattractive profit margins, and finding companies willing to engage in public-private partnerships to finance them may prove difficult.

Carry on with cautious optimism as uncertainty reigns supreme

Market prices have certainly shifted since the election of Donald Trump prompted more bullish sentiment for economic growth, inflation, and interest rates in the United States and, to a lesser degree, in Europe. In our view, the consensus has the probable positive direction of all of these indicators correct, but the expected timing and magnitude of these moves seem overly optimistic. In the United States, pending policy changes may be implemented later, and with weaker efficacy, than current asset valuations suggest. In Europe, too, political risks aren't adequately reflected in today's market prices.

We see only a few opportunities for improvements in long-term productivity in the proposals put forward by the White House and by campaigning parties in Europe. That being said, the news isn't all bad. Even in the absence of boosts to long-term productivity, we believe the United States is poised for 2% economic growth, with the eurozone following at about a half-point lower in aggregate. Strong economic growth tends to heal all wounds, but tepid growth doesn't need to be a reflection of doom and gloom. The United States is fundamentally a 2% growth economy. That is nothing to write home about, but with unemployment rates coming down, and with standards of living improving, the typical inhabitant isn't fixated on headline GDP figures. Perhaps we shouldn't be either.

Diversification does not guarantee a profit or eliminate the risk of a loss.

Important disclosures

Important disclosures

Diversification does not guarantee a profit or eliminate the risk of a loss.

Investing involves risks, including the potential loss of principal. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Growth stocks may be more susceptible to earnings disappointments, and value stocks may decline in price. Large company stocks could fall out of favor, and foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default.

MF364473