An uptick in market sentiment calls for cautious optimism

A surprise victory by Donald Trump has inspired market moves that have caused some analysts and investors to posit that we are entering a new era. The markets have certainly given their prognosis of what a Trump administration means for the economy and financial assets. Since Election Day, the S&P 500 Index and yields on the 10-year U.S. Treasury have risen, along with inflation expectations.

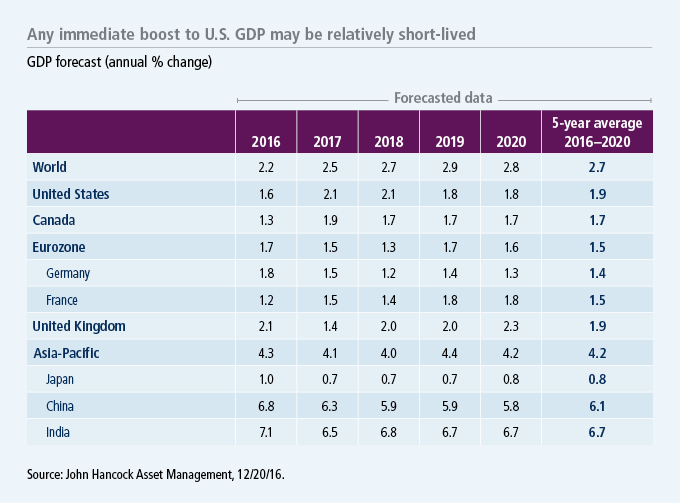

Our view is more cautious. Despite expectations of moderately higher growth, inflation, and interest rates, we still live in a global macroeconomic environment characterized by low growth, low inflation, and low interest rates relative to history.

Extreme uncertainty accompanies this transition of power in U.S. government

Uncertainty surrounding the U.S. macroeconomic forecast over the next few years is much higher than usual as Mr. Trump prepares to take office and to begin pushing for certain measures he promised during the campaign. So far, all we have to go on from a policy perspective is what Mr. Trump said on the campaign trail, what he has tweeted since, who he has appointed to his cabinet, and what we expect will actually be feasible. There is reason to believe that the markets have at least the direction of moves in growth, inflation, and interest rates correct; however, we think there are a number of factors that will restrain the magnitude and delay the timing of these moves.

Trump trade policies may raise inflation rates moderately, counterbalanced by U.S. dollar strength

During his campaign, Mr. Trump repeatedly vowed to impose tariffs on some of the largest U.S. trading partners. Any tariffs levied against China, Mexico, or others are likely to push up U.S. import prices, which could increase domestic inflation. However, a stronger U.S. dollar should at least partially offset that upward inflationary pressure. As the U.S. Federal Reserve (Fed) remains the world's only major central bank tightening monetary policy, the U.S. dollar should continue to appreciate relative to other major currencies, thereby driving the United States to essentially import deflationary pressures from other parts of the world. The border tax that Mr. Trump has proposed is meant to impose a tariff on importers while giving a tax credit to exporters. The U.S. dollar will have to appreciate—perhaps by as much as 25%—to make the current and capital accounts equal. However, this is likely to take time, and policymakers at the Fed and the People's Bank of China in particular will certainly lean against it. In the absence of a currency adjustment, a border tax will perform the same role as a tariff.

Tax-cut stimulus may prove marginal relative to heightened expectations

Tax cuts remain among Mr. Trump's less controversial proposals in the context of conventional Republican party politics. We expect corporate taxes to be reduced from 35% to 15%. Personal income-tax rates are also likely to decline and be consolidated into three brackets: 12%, 25%, and 33%. If income taxes are reduced, so the theory goes, then we should see more consumption, which should boost economic growth.

However, lower-income taxpayers—those with a higher marginal propensity to consume—would see less tax relief than the top earners in this case. Moreover, the chairman of the U.S. House Ways and Means Committee intends to oppose any tax cuts that would reduce federal revenue, which may prompt the government to tweak existing tax deductions. Such broader tax reform would be more complex and time-consuming than mere cuts. We may have to wait until 2018 to see a growth boost from the tax front.

Defense and infrastructure spending might face stronger resistance

Mr. Trump's proposed spending plans for infrastructure ($1 trillion) and defense (amount unspecified, but estimates are $8 billion to $9 billion over the next decade) may face challenges from a number of House Republicans.1 The Trump administration expects to pay for these fiscal stimulus measures with prospective growth of around 4%, which is extremely unlikely in our view. The impact of these stimulus measures on the budget is therefore bound to be significant. It is worth recalling that it was members of the Republican party who refused to raise the debt ceiling back in 2013, forcing a government shutdown. Perhaps the House Republicans will be more lenient on running up the deficit and debt burden now that they are in charge of the spending, but it is realistic to expect some opposition. At the very least, these spending measures are likely to be debated and delayed. Consequently, most infrastructure projects may not be shovel-ready until 2019 or 2020.

Moreover, the most important infrastructure spending projects in terms of boosting long-term productivity include building schools and roads. Private firms are unlikely to participate in these projects because they are unprofitable. It is therefore likely that the infrastructure spending we do see simply serves to boost inflation without boosting productivity growth.

U.S. fiscal expansion won't incite enough demand to address global oversupply

While there is some reason to expect growth and inflation to accelerate and long-term rates to rise moderately, we think the consensus view may be too optimistic. Fiscal expansion in the United States is a necessary but insufficient requirement to stimulate enough aggregate demand to address global oversupply. What we need is a globally coordinated fiscal stimulus alongside continued monetary easing. We expect a fiscal stimulus in Japan and potentially in China, but a significant fiscal stimulus is incredibly unlikely in Europe. This is in large part because of German orthodoxy: The eurozone's largest economy is already enjoying low unemployment and a high standard of living and therefore prefers to maintain a balanced budget rather than borrow for spending. The German government is even less likely to shift this stance in an election year.

Unfortunately, it may be Europe that needs a fiscal stimulus the most. Europe faces significant potential political instability next year given its incredibly busy election schedule. In addition to planned elections in the Netherlands, France, and Germany, there may well be snap elections in Italy and Greece as well. In each of these countries, the centrist parties are under pressure from increasingly successful populist parties. These populist parties have found sympathy for their often anti-elite, antiglobalization, and anti-European messages among people who feel they have been left behind economically or worry they might be left behind in the future. A globally coordinated fiscal and monetary stimulus could create enough aggregate demand to pull much of the developed world out of the economic doldrums and to take the wind out of the populists' sails. Unfortunately, we are unlikely to see this any time soon.

Last year was full of political and economic surprises, including Brexit, the U.S. elections, and the Italian constitutional referendum. While some analysts and investors hope that Mr. Trump's policies will pull the global economy out of the low-growth, low-inflation, and low interest-rate environment, we remain skeptical.

1 Source: John Hancock Asset Management, 12/31/16.

Important disclosures

Important disclosures

The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. It is not possible to invest directly in an index.

Investing involves risks, including the potential loss of principal. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Growth stocks may be more susceptible to earnings disappointments, and value stocks may decline in price. Large company stocks could fall out of favor, and foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default.

MF343623