How central banks distort the predictive power of the yield curve

Editor's note: This material originally appeared in the Financial Times on 9/3/18.

I have a bet with some colleagues that we’ll see the yield curve invert before the end of next year. This hardly seems a bold call given that the gap between 2- and 10-year Treasury yields narrowed to below 20 basis points in late August—a postfinancial crisis low. So I’m going to propose another question on an even thornier issue: If the yield curve inverts, will we actually care?

In theory, we should. The yield curve charts the difference in compensation that investors receive for holding debt of different maturities. It usually slopes upward to the right, to reward investors for locking up their money for longer. But if investors think the economy is about to go into recession, they demand a higher premium for holding short-term bonds than longer-term debt and the curve is inverted.

Yield curves have been better than most economists at predicting U.S. recessions, although there’s some debate about which part of the curve to use. Investors typically focus on the gap between 2- and 10-year yields, while academics favor the spread between 3-month bills and 10-year notes.

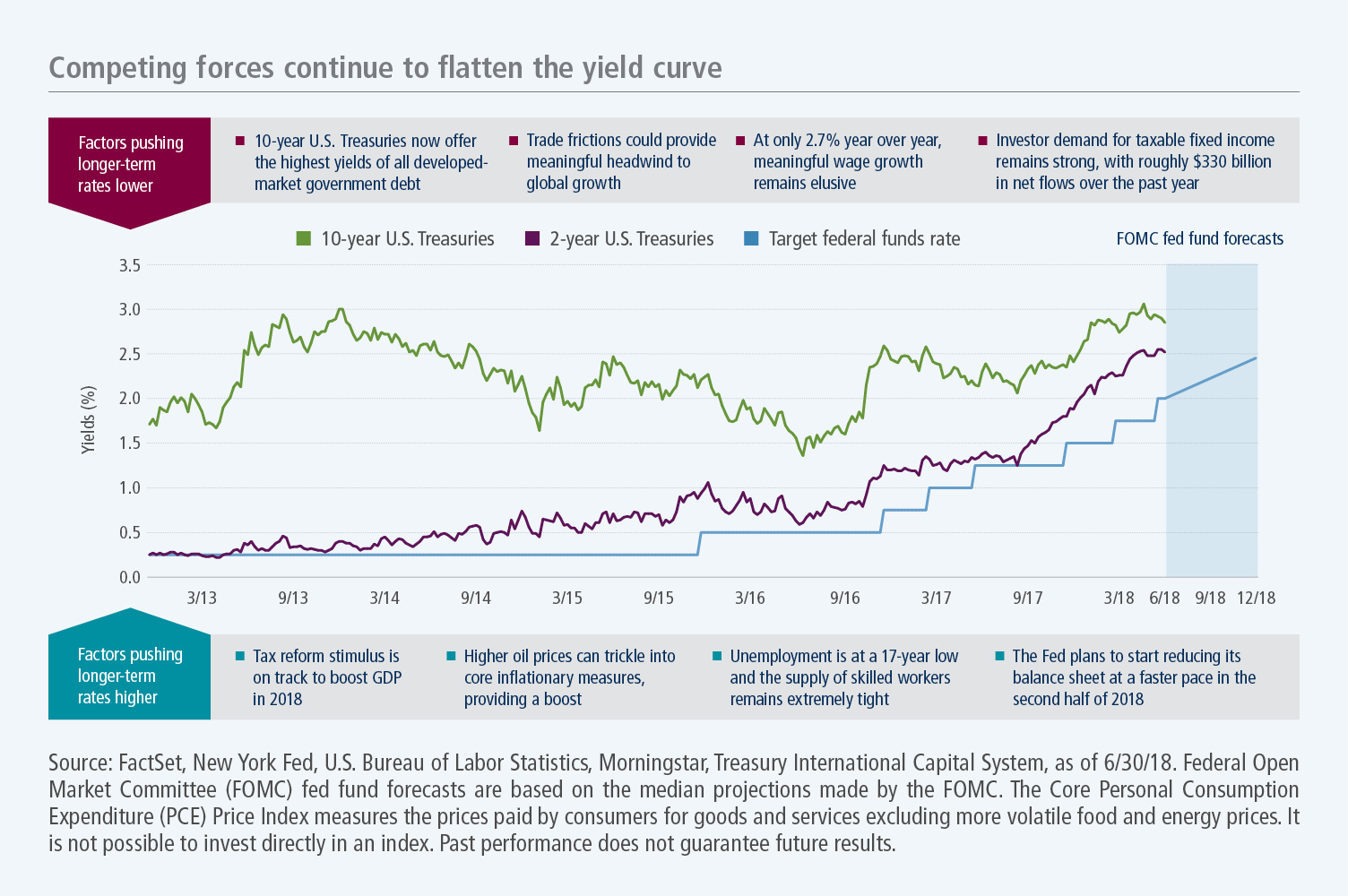

A paper from U.S. Federal Reserve (Fed) Board researchers suggests that a spread of short-term interest rates may be best. All three metrics turned negative a year or two before each of the seven U.S. recessions since the 1970s. You can argue that one curve is better than another, but all of them put us economists to shame. As the Fed lifts interest rates during an economic recovery, the short end of the yield curve goes up. But the central bank has little control over longer-term rates. Those are determined by expectations for short-term rates, inflation, and the “term premium,” the bonus investors demand for the risk of holding an asset for a longer period. If the economy seems to be faltering, investors expect inflation to ease and so longer-term yields fall.

While the yield curve has a successful record predicting downturns, seven recessions is not a huge sample size. Some economists argue that policy shifts and structural changes mean the yield curve’s signal is now distorted. The U.S. Treasury Department is currently borrowing more money to finance predicted big budget deficits and it has mainly done so with short-term debt. That increase in supply has pushed the price of bills and short notes down and their yields up (bond prices and yields move inversely).

At the same time, global quantitative easing has created a seemingly insatiable demand for 5- to 10-year Treasuries, pushing down yields. This means that the yield curve may be flattening for financial rather than economic reasons. Meanwhile, expectations for the neutral rate (when real gross domestic product grows at trend while inflation remains stable), inflation and term premia have been consistently lower than before the financial crisis. That means longer rates have been lower, making it easier for the yield curve to invert as short-term rates continue to rise.

Finally, deflation fears have made long-term bonds a useful hedge for equity investors concerned about a stock price correction. That also boosts demand and represses long yields.

All of these factors make it easier for the yield curve to invert, but none seems to reflect particular concerns about the economy. An inversion this time need not necessarily indicate a recession is nigh. I’m sympathetic to the arguments that this time is different, but reluctantly so. Don’t forget that in 2006, then-Fed chair Ben Bernanke insisted the yield curve’s signal was being distorted by structural factors, two years before the 2008 crash.

It may not matter whether the yield curve’s predictive powers are distorted. If the markets, companies, and individuals believe an inverted yield curve means there’ll be a recession, they’ll behave accordingly. An economic downturn will then become a self-fulfilling prophecy—and I’ll win my bet.

Important disclosures

Important disclosures

The views expressed are those of the author(s) and are subject to change. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index.

MF595603