History lessons

PRESENTATION SLIDES

If you ask what the markets are going to do, the answer would be that they're going to fluctuate. Volatility can feel like the ups and downs of a roller coaster. While we know that past performance doesn't guarantee future results, when it comes to behavior of markets, patterns typically repeat themselves. Circumstances may change but patterns rarely do. History lessons is a walk down memory lane to see where we've been and a peek around the corner to see where we may be going.

In this session, we will use data to answer the following questions:

- What does the history of market returns tell us?

- Is diversification dead?

- Is there a wrong time or right time to invest?

- What do inflation and interest rates mean for my life and my portfolio?

- What do I do now?

FLYER

Investors who abandon stocks in a downturn may miss out on their eventual recovery

One of the most difficult things for an investor to do is to avoid panicking during a market downturn and selling stocks when they’re at their lowest point. For example, many investors abandoned stocks and moved to bonds or cash during the worst of the 2008/2009 financial crisis, when staying invested would have provided the best outcome over the long term.

FLYER

Sequence of returns flyer

The sequence of returns may have less of an impact on the portfolio of someone who is still working and accumulating assets for retirement; however, during retirement, the relationship between an individual’s rate of withdrawal and the sequence of returns can have a dramatic impact on a portfolio’s overall ability to last. It is, therefore, very important to understand how it may affect your future lifestyle, and plan accordingly.

FLYER

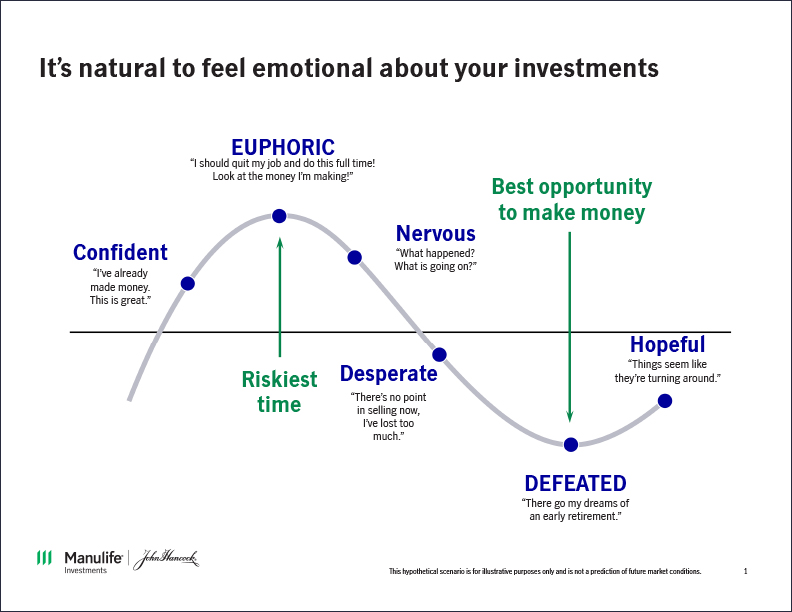

Emotional rollercoaster flyer

It's natural to feel emotional about your investments.

VIDEO

History lessons

Business Consultant Jason McKinney takes a walk down memory lane to see where financial markets have been and where they may be going. He shows that while past performance isn't indicative of future results, market patterns often repeat themselves.