Financials have more going for them than the election results

Financial stocks rallied sharply following the surprise U.S. presidential election results, fueled by Mr. Trump's call for loosening restrictions and the fact that Republicans maintained control of Congress.

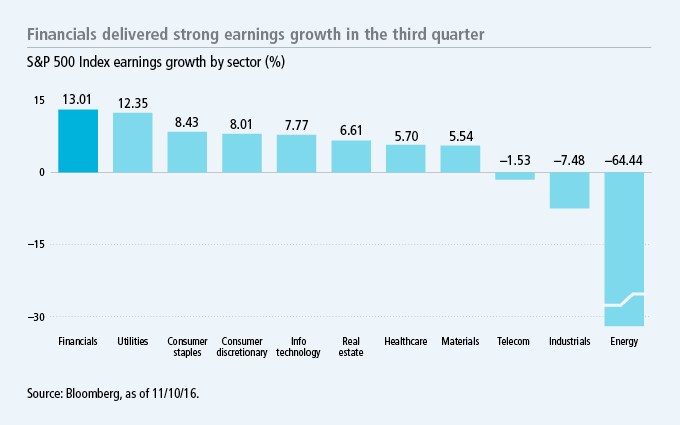

However, even without the rollback of regulations, financial stocks have begun an earnings turnaround that should provide a tailwind for the sector in the months ahead. An astounding 84% of financial companies beat earnings estimates in the third quarter, with the sector delivering an average earnings growth of just over 13%.1

Equity asset managers in our network have been increasing exposure to the financials sector over the past year based on the thesis that relatively attractive valuations and the potential for improving fundamentals would begin to support stock prices. Today, we're seeing that thesis begin to play out.

Forward price-to-earnings (P/E) ratios of the sector relative to the overall market show just how attractively valued the sector is on a historical basis. Financials have a forward P/E ratio of 12.4x, versus 16.3x for the S&P 500 Index as a whole—a 25% discount to the market—whereas over the past 10 years, financials have historically traded at a 15% discount.2 Given the election outcome and recent earnings results, this discount is likely to close in the coming weeks and months.

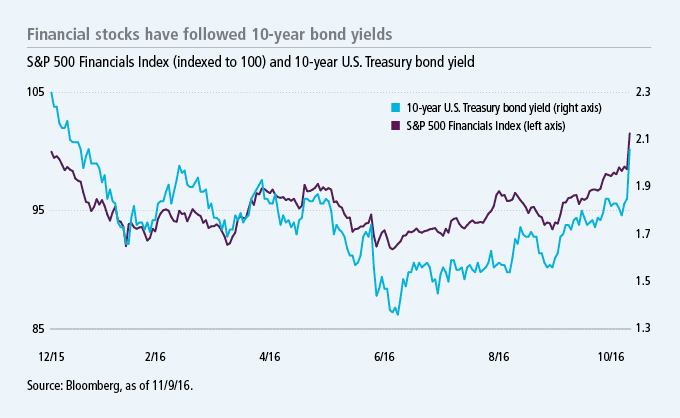

Another positive indicator cited by several equity managers in our network is the rising level of bond yields, which helps increase net interest margins for banks; in fact, performance of the sector has been closely correlated with the 10-year U.S. Treasury bond yield for several years. Taken together, financial stocks have some tailwind for the first time in a while that may support stock prices with or without regulatory changes.

1 Bloomberg, as of 11/10/16. 2 Bloomberg, as of 11/9/16.

Important disclosures

Important disclosures

The forward price-to-earnings (P/E) ratio is a stock valuation measure comparing the current share price of a stock with the underlying company's estimated earnings per share over the next 12 months. The S&P 500 Index tracks the performance of 500 of the largest publicly traded companies in the United States. The S&P 500 Financials Index tracks the performance of financial companies in the S&P 500 Index. It is not possible to invest directly in an index.

Investing involves risks, including the potential loss of principal. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Growth stocks may be more susceptible to earnings disappointments, and value stocks may decline in price. Large company stocks could fall out of favor, and foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default.

MF328958