Comparing funds in three easy steps

With more than 10,000 mutual funds and ETFs available in the United States, side-by-side comparisons are a great way to determine the relative pros and cons of funds you’re researching. Our Fund Compare tool was designed to help.

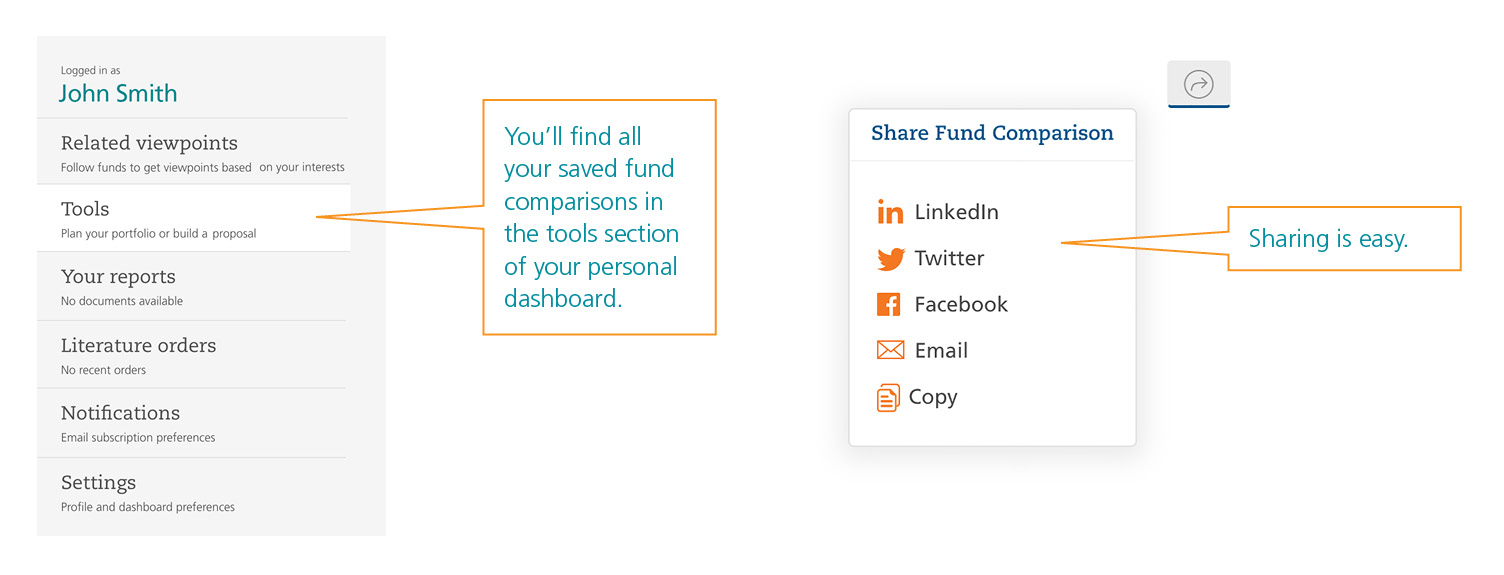

Powered with data from Morningstar, Fund Compare lets you research up to five funds and/or ETFs at a time—in any combination you can think of—and there’s no requirement to use a John Hancock fund in the comparison. Registered users of the site can save comparisons for later use (the data will update automatically) and share those comparisons at any time over email or social media.

Here are three easy steps to get started:

Step one: launch Fund Compare

Fund Compare can be launched either from the homepage of jhinvestments.com, the resources section, or from any John Hancock fund page you’re exploring. We recommend bookmarking the page once you’ve launched it.

Step two: add funds and/or ETFs to compare

From the Fund Compare page, you can add just about any fund or ETF in Morningstar’s database. You can search by ticker or by product name, in which case the search bar will suggest tickers. Note that for mutual funds, comparisons are share class specific. You won’t be prevented from using different share classes in your research, but to get a true apples-to-apples comparison, you’ll want to use the same share class.

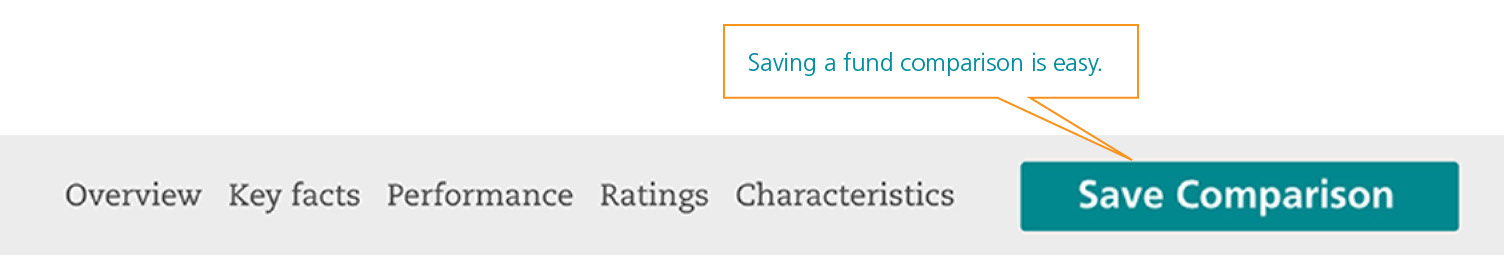

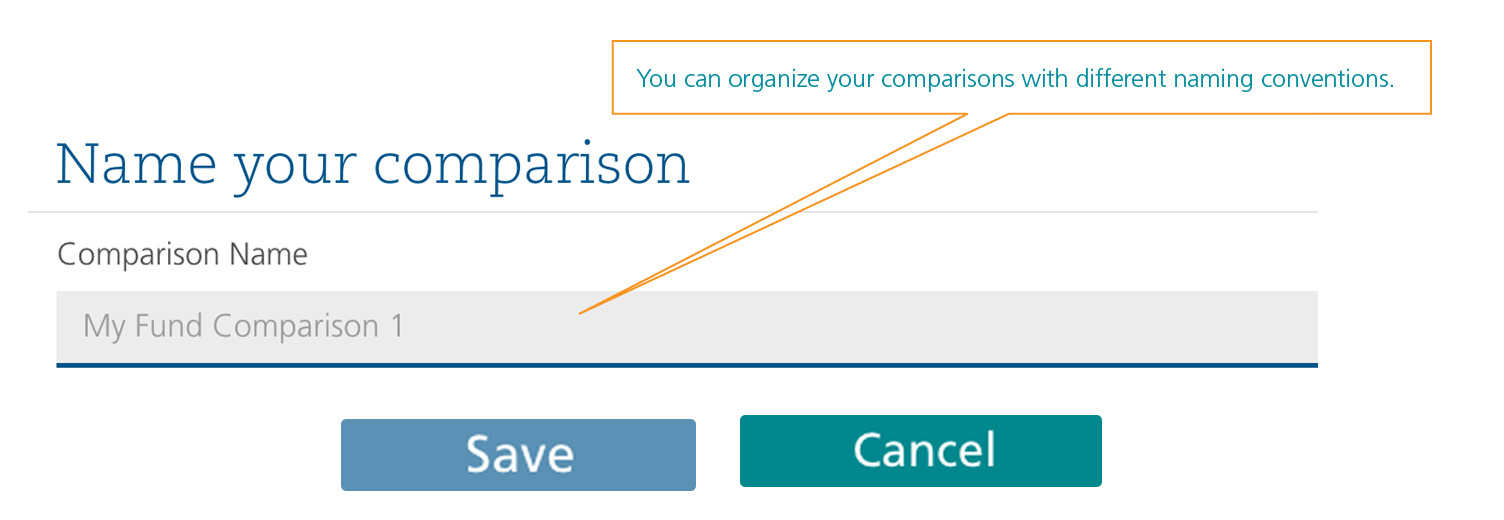

Step three: save and share your research

After you’ve found a useful comparison, you may want to save it and refer to it later. Fund Compare was created so that all saved comparisons will load with the most recent performance, so you never have to worry about a comparison getting stale. Note that you’ll have to register for the site to use this feature, a process that takes less than a minute to complete.

We hope you enjoy using Fund Compare. Our goal was to use one of the most powerful data engines available—Morningstar—but to take the away the complexity and provide users with loads of interactive data visualizations. Try Fund Compare today!

Important disclosures

Important disclosures

ETFs are bought and sold through exchange trading at market price (not NAV), and are not individually redeemed from the fund. Share may trade at a premium or discount to their NAV in the secondary market. Brokerage commissions will reduce returns. A commission is charged on every trade.

Investing involves risks, including the potential loss of principal. These products carry many individual risks, including some that are unique to each fund. Please see each fund’s prospectus to learn all of the risks associated with each investment.

Investors should request a prospectus or summary prospectus from their financial professional. The prospectus includes investment objectives, risks, fees, expenses, and other information that should be considered carefully before investing.

MF816026