There will be no easy answers for the Fed at its June meeting

The IMF/World Bank spring meetings I just attended were among the most uneventful I've been to. The attendees were surprisingly sanguine about the growth prospects in China, emerging markets, Europe, and the United States.

It was surprising to see this in a year that began with such unprecedented volatility. I attribute the relative calm to one factor above all others: U.S. dollar (USD) weakness. A weaker USD in the first quarter (Q1) drove oil prices slightly higher and eased financial conditions in emerging markets considerably. That USD weakness was itself driven largely by a U.S. Federal Reserve (Fed) that appeared more dovish in March than it had in December. However, the current market rally risks running out of steam if the USD strengthens again. The April 26–27 Federal Open Market Committee (FOMC) meeting and the initial Q1 GDP release gave us little insight into what the Fed will do going forward. We still expect two rate hikes this year, but it's more likely we'll see only one than it is that we'll see three.

April's FOMC press release left the door open

April's FOMC meeting was not accompanied by a press conference and, consequently, analysts must pore over the press release to try to detect any hint of a change in the Fed's thinking. After having painted herself into a very cautious corner during her March speech at the Economic Club of New York, Fed Chair Janet Yellen bought herself a little more wiggle room in April's press release. On the one hand, the Fed downplayed global economic and financial risks in April compared with March. This suggests the Fed's next meeting in June is now live for a rate hike. On the other hand, the Fed highlighted that household spending growth had decelerated, indicating concerns about U.S. GDP growth. This kind of equivocal language is standard operating procedure for the Fed, and its press release had something for hawks and doves alike. The bottom line is that a June rate hike is possible, but not at all inevitable.

Q1 U.S. GDP disappoints, again

While Q1 GDP in the United States came in below consensus at 0.5% on an annualized basis (down from 1.4% in Q4), it also gave us little insight into how the Fed might act going forward. First-quarter U.S. GDP growth has historically been lackluster because of a number of seasonal adjustment issues, and 2016 was no different.

Consumer demand—the engine of the U.S. economy—decelerated to 1.9% year over year (down from 2.4% in Q4), in part because of stock market weakness that ate into household wealth. Investment plummeted by 5.9% (previously –2.1%), the worst we've seen since 2009. This is partly owing to a relatively strong USD and a continued collapse in oil and gas drilling. Government consumption grew by 1.2% and residential construction jumped by 14.8%, in part as a result of mild winter weather. Net trade dragged on growth (real exports were down 2.6% while imports were up 0.2%), again partly owing to a relatively strong currency. Inventories were a larger drag on GDP growth than expected in Q1, and while inventory levels remain high, they should drag a little less on Q2 GDP growth.

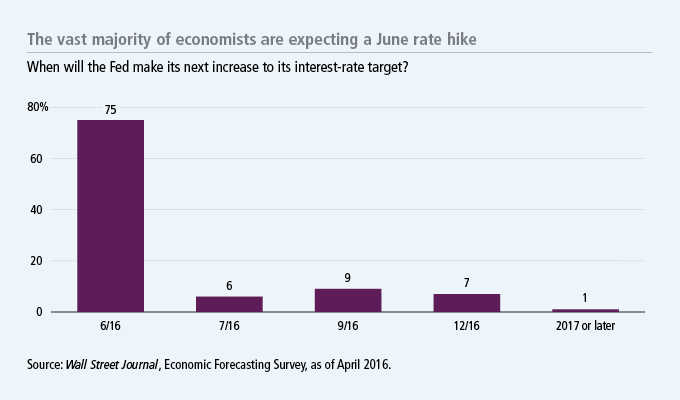

Our call: the Fed is more likely to hike rates in June than to hold steady

With an ambiguous FOMC press release in April and lackluster Q1 GDP growth, what is the Fed's next move? The Fed's favorite metric for inflation—core personal consumption expenditures (PCE)—could offer ahint. According to the latest data, core PCE growth accelerated to 1.7% year over year in Q1, which is still below the Fed's target of 2.0%. Given that inflation has been below target for so long, the Fed should be tolerant of higher-than-desired inflation before hiking rates; therefore, according to this metric, the Fed should stay on hold.

Another reason the Fed might hold off on a rate hike in June is because of the referendum in the United Kingdom on whether to leave the European Union (EU)—that vote will take place a week after the June FOMC meeting. If the Brexit (the financial press's shorthand for British exit) opinion polls indicate the ballot will be close—as we expect it to be—the Fed might choose to stay put. If the United Kingdom does vote to leave, it will be hugely destabilizing for both the United Kingdom and for the rest of the EU, with potential global repercussions. It would be a bad time for the United States to hike rates and further tighten global financial conditions.

Despite these reasons for waiting a little longer, we believe the Fed will indeed hike rates at its next meeting, although we don't have high conviction. A lot will depend on the data released between now and June. Our view is that central bankers the world over—not just at the Fed—are desperate to normalize monetary policy. If the data justifies a rate hike, we expect the Fed will go ahead and implement one; we then expect a second rate hike to come in December. The risks to this call are entirely on the downside—again, there is a greater chance of having one or fewer rate hikes this year than three. The markets are currently pricing in a roughly 20% chance of a rate hike in June. If the Fed does tighten then, we would expect to see the USD strengthen again and financial conditions tighten in emerging markets, reversing some of the recent rally we have enjoyed. It's not an enviable position for the Fed. At the moment, there are no easy policy answers.

Source: All data is from The Bureau of Economic Analysis, April 2016.

Important disclosures

Important disclosures

Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability.

MF293803