Mind the market rotation

Even though U.S. equities already stood on the high side of fair value prior to Election Day, growth-starved investors took the promise of government's willingness to spend as a positive sign that economic growth had a new champion, and therefore earnings growth a new catalyst. U.S. business and consumer confidence indicators have since risen, along with the country's stock prices and bond yields.

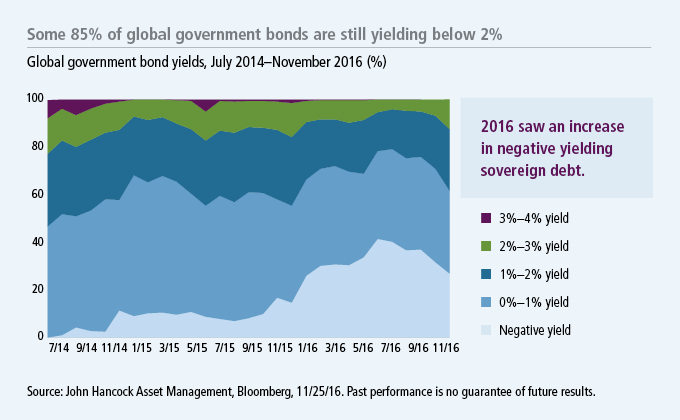

Bondholders headed for the exits, in part because the growth prospects suddenly seemed rosier for stockholders, but also because the expected fiscal stimulus might spark additional inflationary pressure. So where to now?

Timed right, the short-term stimulus from tax cuts and defense spending could propel the economy into the 2018 midterm elections. The infrastructure and corporate tax reforms operating with a delay could stimulate the animal spirits into the next presidential election in 2020. These stimulus measures sound great, except that the U.S. economy is already chugging along with low unemployment. More stimulus at this point is akin to giving an overactive child a handful of sweets, but this economic sugar rush would likely exacerbate inflation risks.

Moreover, who will fund this massive uptick in deficit spending, which will require a lot of new U.S. government bond issuance? Since the global financial crisis, a timid investor class has happily poured money into bonds. But now that the long-awaited rotation from fixed income to equity appears to have started, so mutual fund holders as a group may not be among the most likely marginal buyers of more U.S. government debt. The other big bond buyers, China and the oil-rich producers in the Middle East, have recycled trade surpluses with the United States for years, but foreign interests have turned into significant net sellers over the past several months. If the budget hawks don't discipline government spending, it will fall to the bond market vigilantes, who will demand higher coupons; these higher interest rates, in turn, will blunt the effectiveness of much of the sugary stimulus.

Looking past all the recent developments, there is a balanced case for investors maintaining a globally diversified portfolio over the long haul. Still, there are always market mispricings, even when abundant capital has narrowed the value differentials across so many asset classes. Our outlook for each of the major categories follows.

Pricey U.S. equity valuations may stay expensive for some time to come

The rally in U.S. equity markets following Election Day has been built on the hope of deregulation, corporate tax reform, personal tax cuts, defense spending, infrastructure investment, and other initiatives-without much thought as to how these programs will materialize. Our five-year forecast reveals that valuation opportunities outside the United States are much better. But the quality of the U.S. story is superior, and the country continues to be the default dwelling for a large swath of the globe's capital, which would keep valuations at fairly high levels for the foreseeable future.

Strong arguments for and against European equities net a neutral view overall

Our views on valuations favor European over U.S. equities. However, investors need to contend with currency risk embedded in the euro. European growth has been steadily improving on the accommodative monetary policies. Also, the weakened euro has aided exports. As depressed profit margins revert to their higher historical averages, there are real opportunities for material gains in European equities. But the geopolitical risks are enormous—Brexit, the refugee crisis, and upcoming elections across the Continent call the sustainability of business confidence into question. Investors need to remember that real value opportunities often reside with high degrees of discomfort.

Japan's equity market shows promise despite a legacy of disappointment

We have been optimistic about prospective improvements in Japanese corporate governance, particularly with respect to shareholders' return on equity (ROE). Now that ROE is rising, Japanese equity valuations look attractive. Long-frustrated investors are unlikely to believe the change is sustainable given Japan's corporate history. We've maintained a contrarian posture with the belief that the upturn will endure. As the Japanese yen weakens in response to a rising U.S. dollar, investors may find an attractive entry point, provided they're prepared for a long horizon.

Emerging-market equity prospects are bright for those comfortable with the risks

We remain positive on emerging-market equity. Our five-year return forecasts here are higher than those for other asset classes. Valuations look attractive, and momentum is building across a number of emerging economies. Still, the caveats include renewed U.S. dollar strength, which tightens financial conditions.

Moreover, a new wave of protectionist policies also threatens decades of free trade advances. Also, a devaluation of the Chinese yuan—a re-emerging global risk—would be a near-term negative. But China's long-term prospects remain intact. The divergences across emerging-market countries belie a monolithic asset class. Instead, we see unique opportunities in select local markets. Northern Asia, for example, offers consumer- and technology-driven growth prospects.

U.S. bonds provide diversification potential following a multi-decade bull market

U.S. fixed-income expected returns have improved marginally in recent weeks and remain more attractive than those for international developed bond markets. Intermediate-term U.S. yields remain positive and marginally higher than the domestic inflation rate. Long-dated issues, which were showing signs of exhaustion in their upward price trajectory, finally delivered the first steep step down as we had expected. Post adjustment, there are further inflation and policy headwinds building. We see more potential rounds of bond price corrections ahead. We remain constructive on credit risk and cautious on interest-rate risk.

Emerging-market debt remains a favored fixed-income category

Emerging-market debt (EMD) has seen a setback on resurgent strength of the U.S. dollar. We view U.S. dollar-denominated EMD favorably in light of this rate reset, especially given its relative yield advantage over most other segments of the global bond market. Still, developed-market bonds may be in for a tough period, and when the world sneezes, EMD usually gets pneumonia.

That said, the underlying country financials look better than they have in decades. In an era of subdued expectations for most fixed-income assets, we see the long-term prospects for EMD as a potential exception.

Important disclosures

Important disclosures

ROE, or return on equity, is calculated by dividing net income by shareholders’ equity.

Diversification does not guarantee a profit or eliminate the risk of a loss. Investing involves risks, including the potential loss of principal. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Growth stocks may be more susceptible to earnings disappointments, and value stocks may decline in price. Large company stocks could fall out of favor, and foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default.

MF343622