Pursuing market premiums through a time-tested multifactor approach

In September 2015, when John Hancock Investment Management entered the ETF business with the launch of our suite of John Hancock Multifactor ETFs, it was after years of research and deliberation over how these products would stand out and offer investors real value in an already crowded market. This is the same process we use to vet any potential fund offering, and it's one we've honed over our 25+ years as a manager of managers.

Key takeaways

- In designing our suite of John Hancock Multifactor ETFs, we turned to Dimensional Fund Advisors and their emphasis on equity characteristics—smaller capitalization, lower relative price, and higher profitability—that have demonstrated outperformance over time.¹

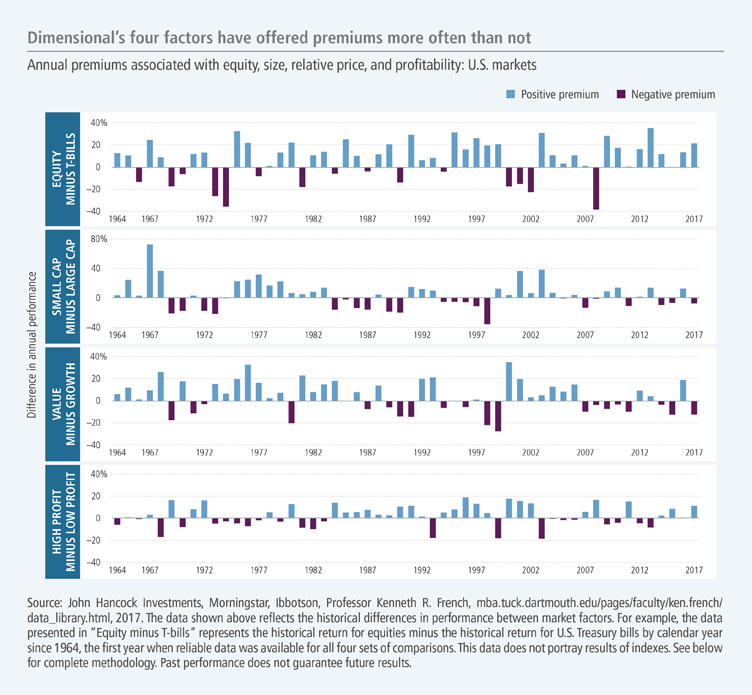

- Although in any given year any or all of the factors in Dimensional’s model could underperform, more often than not, Dimensional’s factors have outperformed over both the short and long term.

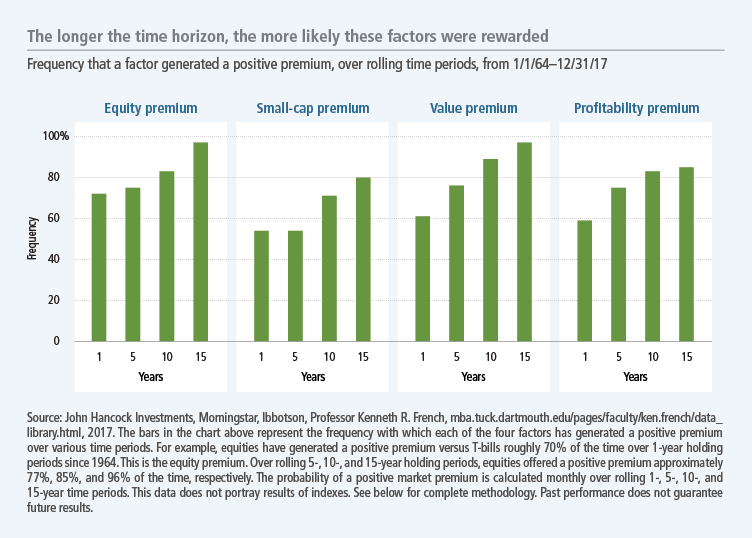

- While this multifactor approach has been shown to offer benefits over the shorter term, the longer the investment holding period, the more likely those factors were to deliver a positive market premium.²

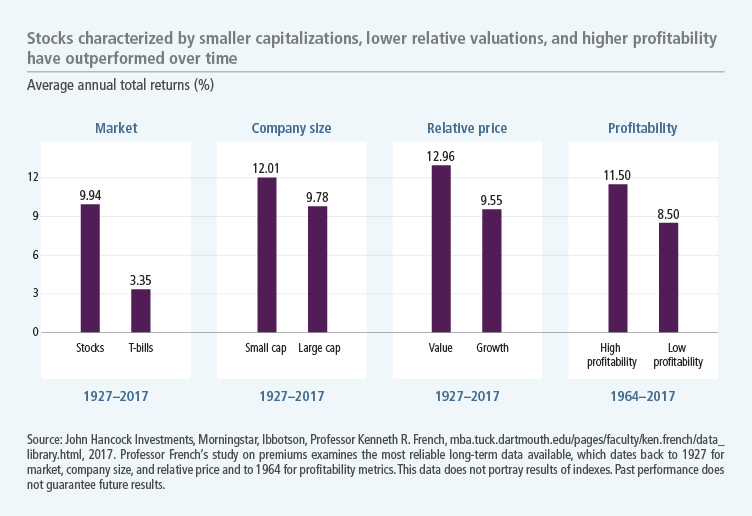

- Over the long term, the performance advantage of Dimensional’s multifactor approach has been significant.

In working with Dimensional Fund Advisors—a company considered one of the pioneers of multifactor investing—to design our suite of exchange-traded funds (ETFs), we sought to craft investment strategies that were meant to serve as core, long-term holdings with the potential to outperform purely passive, market-cap-weighted strategies. Broadly speaking, that's what strategic beta strategies seek to deliver: the potential for outperformance by emphasizing specific segments of the market. John Hancock Multifactor ETFs, which track indexes designed by Dimensional, are built to do just that by tapping into factors that have historically generated premiums over time and across equity markets around the world.

The benefits of a multifactor approach

Dimensional has spent more than 30 years researching which factors offer the best chances of improving a portfolio's performance over the long term. A landmark 1992 study by University of Chicago Professor Eugene Fama and Dartmouth College Professor Kenneth French argued that, based on history, focusing on smaller stocks and those with lower relative prices3 may improve a portfolio's expected return.4 Subsequent research conducted by University of Rochester Professor Robert Novy-Marx identified profitability5 as another factor that enhances expected returns.6 Today, Dimensional offers investment solutions built on the idea that combining these specific factors, borne out by decades of rigorous research, can produce better outcomes for investors over the long term.

The longer the time horizon, the more likely these factors are to be rewarded

While Dimensional's factor-driven model has much to support it, it's important to note that there's no guarantee that each or any of these factors will outperform from year to year. Take, for example, the first and most uncontested factor in Dimensional's model: the idea that stocks outperform T-bills over time. Investors know that stocks come with no guarantee; the equity markets are volatile, and years with losses are not uncommon. But investors also know that stocks offer the potential to significantly outperform risk-free assets such as T-bills over time.

It's no surprise, then, that the longer an investor maintains exposure to a certain factor, the more likely that factor is to deliver a positive result; for example, over rolling one-year periods since 1964, small-cap stocks delivered a positive premium over larger stocks nearly 54% of the time. Stocks with low relative prices and high profitability, meanwhile, each outperformed their counterparts about 60% of the time. When those holding periods are increased to rolling ten-year periods, the chances of any of the four factors outperforming jump to at least 74%.7 While past performance doesn't guarantee future results, we believe this data makes a compelling case for this factor-based approach: Not only does each factor have a better likelihood of outperforming over the short term, over longer periods, the probability of a positive premium increases significantly.

A factor-based approach that 's delivered measurable results

Of course, from year to year, there's no telling whether smaller-cap, lower relative price, or higher profitability stocks will outperform their respective counterparts. Looking back over the past 50+ years, the answer is that those factors frequently do outperform, but to have predicted when they would outperform is an impossible task.

Again, while these studies are backward looking and don't guarantee future results, we believe this data strongly makes the case for biasing a long-term equity portfolio in favor of the size, relative price, and profitability factors that Dimensional's research suggests do indeed offer premiums.

1 The cited study by Professor Kenneth French demonstrates the historical tendency of stocks characterized by smaller size, lower relative price, and higher levels of profitability to outperform over time. 2 A premium represents the excess return that securities with particular characteristics have historically generated. 3 Relative price as measured by the price-to-book ratio; value stocks are those with lower price-to-book ratios. 4 “The Cross-Section of Expected Stock Returns,” Eugene F. Fama and Kenneth R. French, Journal of Finance, June 1992. 5 Profitability is a measure of current profitability, based on information from individual companies’ income statements. 6 Robert Novy-Marx provides consulting services to Dimensional Fund Advisors LP. 7 John Hancock Investment Management, Morningstar, Ibbotson, Professor Kenneth R. French, 2016.

Important disclosures

Important disclosures

The charts above are based on the performance for different groupings of stocks within the broad equity universe. A premium represents the excess return that securities with particular characteristics have historically generated. The chart above shows historical geometric mean performance for different groupings of stocks within the broad equity universe. This universe, or market, includes stocks listed on the NYSE, AMEX, and NASDAQ exchanges. The research does not portray results of indexes. T-bill data is from Morningstar, Ibbotson. In order to assess returns of stocks with different characteristics, researchers Eugene Fama and Kenneth French grouped stocks according to size, relative price, and profitability. For groupings based on company size, stocks were ranked by market capitalization, where small cap represents stocks of companies in the bottom 30% of the universe and large cap represents stocks of companies in the top 30% of the universe. For groupings based on relative price, stocks were ranked by book-to-market equity ratios, where value represents stocks of companies in the top 30% of the universe and growth represents stocks of companies in the bottom 30% of the universe. For groupings based on profitability, stocks were ranked by operating profitability (annual revenues minus the cost of goods sold, interest expense, and selling, general, and administrative expenses, divided by book equity), where high profitability represents stocks of companies in the top 30% of the universe and low profitability represents stocks of companies in the bottom 30% of the universe. Drs. Fama and French are directors of and provide consulting services to Dimensional Fund Advisors LP.

Diversification does not guarantee a profit or eliminate the risk of a loss. Selection of other periods may produce different results, including losses. Past performance does not guarantee future results.

This material is not intended to be, nor shall it be interpreted or construed as, a recommendation or providing advice, impartial or otherwise. John Hancock Investment Management and its representatives and affiliates may receive compensation derived from the sale of and/or from any investment made in its products and services.

Diversification does not guarantee a profit or eliminate the risk of a loss.

John Hancock Multifactor ETF shares are bought and sold at market price (not NAV), and are not individually redeemed from the fund. Brokerage commissions will reduce returns.

Dimensional Fund Advisors LP receives compensation from John Hancock in connection with licensing rights to the John Hancock Dimensional indexes. Neither John Hancock Investment Management LLC nor Dimensional Fund Advisors LP guarantees the accuracy and/or completeness of an index (each an underlying index) or any data included therein, and neither John Hancock Investment Management LLC nor Dimensional Fund Advisors LP shall have any liability for any errors, omissions, or interruptions therein. Neither John Hancock Investment Management LLC nor Dimensional Fund Advisors LP makes any warranty, express or implied, as to results to be obtained by a fund, owners of the shares of a fund, or any other person or entity from the use of an underlying index, trading based on an underlying index, or any data included therein, either in connection with a fund or for any other use. Neither John Hancock Investment Management LLC nor Dimensional Fund Advisors LP makes any express or implied warranties, and expressly disclaims all warranties, of merchantability or fitness for a particular purpose or use with respect to an underlying index or any data included therein. Without limiting any of the foregoing, in no event shall either John Hancock Investment Management LLC or Dimensional Fund Advisors LP have any liability for any special, punitive, direct, indirect, or consequential damages, including lost profits, arising out of matters relating to the use of an underlying index, even if notified of the possibility of such damages. Dimensional Fund Advisors LP does not sponsor, endorse, or sell, and makes no representation as to the advisability of investing in John Hancock Multifactor ETFs.

JHAN-2018-03-22-0097