Growing pains: why high volatility in healthcare shouldn't last

Broadly speaking, healthcare stocks have been under increased selling pressure since the third quarter of 2015, despite solid fundamentals and sensible valuations.

There are several reasons for the drawdown; most are temporary, and none, in our view, suggests a material degradation in the outlook for the sector.

We believe healthcare is a long-term growth industry, with demographic trends, extraordinary innovations, and structural shifts in delivery systems driving expansion globally. As always, we're seeking to capitalize on opportunities created by the short-term price disruption by adding to our highest-conviction names in biopharmaceuticals, medical technology, and healthcare services where we see solid business fundamentals and attractive valuations.

Reasons for the recent sell-off

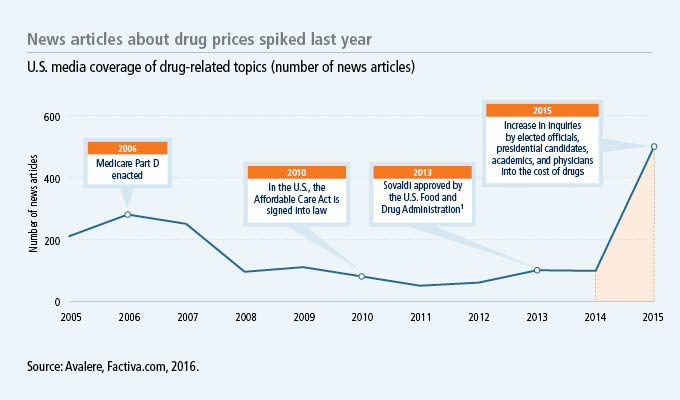

Several near-term pressures have driven the decline in healthcare stocks, creating a negative feedback loop that's based primarily on uncertainty and negative sentiment. During 2015, drug pricing in the United States came under scrutiny, on the heels of a few highly publicized scandals involving excessive pricing of existing treatments. Media attention on this issue was relentless, stoking fears of government price controls.

Not only do we believe that the risk of meaningful structural change in how drug prices are set in the United States is extremely low, we think that the spillover to the entire sector is overblown, especially for biopharmaceutical companies that are developing innovative drugs to treat conditions such as cancer, Alzheimer's, and several rare diseases. In our view, while payers will continue to pressure commoditized products or drug classes, novel treatments that serve unmet or underserved needs offer compelling value, and will be rewarded accordingly across the globe.

However, the air of uncertainty has fueled heavy selling by generalist investors—many of whom likely had overweight allocations to the healthcare sector following several years of outperformance—and accelerated outflows from passive mutual funds and healthcare exchange-traded funds (ETFs). Given our expectations for advances in innovation and growth, we find valuations attractive across the sector, particularly when looking at mid- and longer-term investment horizons.

We also expect that as campaigning of the U.S. presidential election heats up further, so too will the political rhetoric around healthcare costs, including drug pricing. Historically, the sector has tended to trade with higher volatility during election years, and 2016 appears to be no different so far. While volatility may be with us for the next several months, we expect it to subside after the election in November.

Sound fundamentals and solid growth drivers, especially in biopharmaceuticals

While there's good news across the medical technology and healthcare service subsectors, innovation is particularly explosive in biopharmaceuticals, which could represent a larger share of the healthcare pie over the next decade. Unprecedented breakthroughs in disease treatment will command premium pricing.

Examples include immuno-oncology, which is changing the treatment of cancer, and Alzheimer's disease, which is now ripe for meaningful advancement. Novel drug platforms will also facilitate treatments of orphan diseases. Messenger ribonucleic acid (RNA) delivery, RNA interference, gene therapy, and gene editing are all on the horizon. Genomic research is still in its infancy; large-scale genome sequencing combined with population data is yielding unique targets.

We expect that payers will fund these growing pipelines by pressuring undifferentiated categories, adopting biosimilars, and driving demand for generics. In addition, volume and product mix upgrades in emerging markets will contribute to growth for multinationals, and other opportunities will arise as local emerging-economy companies become marketing and innovation leaders.

How we're positioned for this changing market

Change creates opportunities as well as risks, and we remain vigilant to the challenges ahead; the foundation of our investment approach remains consistent. As the issue of healthcare affordability takes center stage, we believe that only those companies offering differentiated innovation and value creation will thrive.

As active managers who have been covering this sector for many years, we're confident in our ability to navigate and capitalize on the inevitable bouts of volatility to our clients' advantage. We've been using the current opportunity to strategically adjust our portfolios, increasing our highest-conviction positions that are selling at what we view as deep discounts to intrinsic value.

As we move deeper into 2016, we have even more confidence that significant drivers of healthcare investment opportunities will continue in the coming years, including groundbreaking innovations in drug treatments.

1 Sovaldi is manufactured by Gilead Sciences, Inc. As of 12/31/15, Gilead was a holding of the fund. Listed holdings are a portion of the fund's total and may change at any time. This is not a recommendation to buy or sell any security. Solvadi and Gilead are trademarks of Gilead Sciences, Inc. or its related companies.

Important disclosures

Important disclosures

The fund's strategies entail a high degree of risk. Leveraging, short positions, a non-diversified portfolio focused in a few sectors, and the use of hedging and derivatives greatly amplify the risk of potential loss and can increase costs. A non-diversified portfolio holds a limited number of securities, making it vulnerable to events affecting a single issuer. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default. Exchange-traded funds reflect the risks inherent in their underlying securities, including liquidity risk. The use of hedging and derivatives could produce disproportionate gains or losses and may increase costs. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Please see the fund's prospectus for additional risks.

MF279122