Banking on long/short experience with a seasoned financials team

Long/short equity strategies offer investors something most long-only mandates can't: potential downside protection.

In managing long/short sector strategies at Wellington Management, our financials team seeks capital appreciation for clients by taking long and short equity positions in financials and related assets through a process that's been in place since the launch of Wellington's first hedge fund in 1994.

We take a broad approach to the financials sector, investing in the equity of insurers, securities brokers, asset managers, thrifts, banks, and companies around the world that serve those industries.

We've learned that opportunities in our sector don't surface without risks. That's why risk management is integrated into our process, informing our individual investment decisions as we make them. As the portfolio's designated coordinator, my duties include monitoring leverage and net exposure, as well as any sector, country, or currency exposures that diverge from the views we develop at our weekly team meetings.

Specialized expertise counts

With an average of 25 years of professional experience, we've each spent our entire careers analyzing and working for financial services companies. We work as a team to identify the best investment opportunities in our industry in any market environment, meeting frequently to exchange ideas, challenge each other, and determine the best allocation of capital. This collective and specialized expertise allows us to take advantage of other market participants' eagerness to trade financials based on macroeconomic headlines without fully understanding the actual business underlying each individual company stock.

Our investment process begins with proprietary fundamental research, including direct contact with companies' management and their competitors. Security selection drives portfolio positioning, and the degree of concentration in a given finance subsector is determined by the availability of attractive individual risk/reward opportunities as well as general market conditions. We employ a bottom-up approach and make investment decisions based on market valuations relative to company fundamentals. We continually seek to buy what we consider good assets at low prices, with the intent of earning superior risk-adjusted returns for shareholders.

Managing net exposure with short selling skills

The implementation of our short ideas in this portfolio is an extension of that used in Wellington's finance hedge funds, which typically obtain roughly a quarter to half of their short exposure through ETFs and other market instruments. Developments in ETFs over the past decade have allowed for greater precision in obtaining the desired short exposure with these instruments today. In our process, we share individual short ideas and short position inputs with our derivatives strategy team. The derivatives team then analyzes the model portfolios of shorts and seeks to construct a similar performance profile through a linear regression and optimization process using market-based instruments, which allows us to implement thematic shorts in the portfolio that may perform similarly to the underlying single-name ideas.

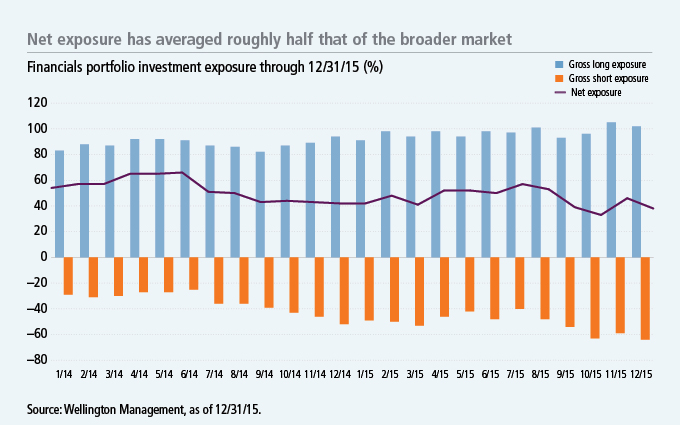

Historically, the portfolio's net exposure has averaged roughly half that of the broader market, with net exposure ranging from about 30% to roughly 70%. However, at any given point in time, we may position the portfolio to have net exposure of anywhere between 0% and 100%, which gives us broad latitude to adjust the beta profile, depending on market conditions and opportunities. Higher net long exposure generally results in environments where we're finding increasing buying (long) opportunities and decreasing selling (short) opportunities.

Conversely, if we become more cautious about the overall market's direction, we can lower the portfolio's net exposure by decreasing its gross long exposure, increasing its gross short exposure, or both.1 This portfolio's net exposure tends to taper down organically when we're finding relatively fewer long candidates and relatively more contenders for short positions.

While long/short investment strategies may underperform during strong bull markets, short selling is an important risk management tool, the benefits of which may become most evident in choppy or downward-trending markets.

1 Gross long exposure is the aggregate of a strategy's long positions, and gross short exposure is the aggregate of its short positions. Net exposure is calculated by subtracting the percentage of the fund's capital invested in short positions from the percentage of the fund's capital invested in long positions.

Important disclosures

Important disclosures

Diversification does not guarantee a profit or eliminate the risk of a loss.

The fund's strategies entail a high degree of risk. Leveraging, short positions, a non-diversified portfolio focused in a few sectors, and the use of hedging and derivatives greatly amplify the risk of potential loss and can increase costs. A non-diversified portfolio holds a limited number of securities, making it vulnerable to events affecting a single issuer. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Investments in higher-yielding, lower-rated securities include a higher risk of default. Exchange-traded funds reflect the risks inherent in their underlying securities, including liquidity risk. The use of hedging and derivatives could produce disproportionate gains or losses and may increase costs. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Please see the fund's prospectuses for additional risks.

MF276381