Behavioral finance—my brain made me do it

Our emotions naturally make it difficult to make smart investment decisions such as buying low and selling high. That’s why many investors sell during market declines—thereby locking in losses—and return only after stocks have recovered. By taking a closer look at some of the basics of behavioral finance, investors can learn to let logic, rather than emotion, drive their investment decisions.

My brain made me do it - strategies to help you make better decisions

This behavioral finance seminar explores why our emotions naturally make it difficult to make smart investment decisions like buying low and selling high.

Approved for use with investors

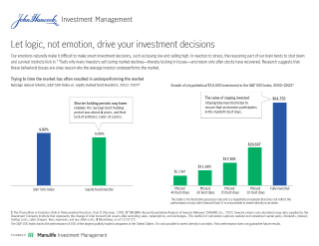

Let logic, not emotion, drive your investment decisions

This piece explores some of the biases that lead many investors to underperform the stock market and presents some logic-driven solutions to help stay on track.

Approved for use with investors

Investors who abandon stocks in a downturn may miss out on their eventual recovery

Sticking to a long-term financial plan gets harder when markets decline. This piece highlights the risks of not staying invested.

Video

My brain made me do it

Business Consultant Craig January helps explain investor biases and offers suggestions on how to avoid six common investor mistakes, including anchoring, procrastination, and paralysis by analysis.