April 19, 2023

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

An error occurred while processing your request. Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

An error occurred while processing your request. Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

An error occurred while processing your request. Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

Enter your password to login.

To verify your identity, we need to send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

An error occurred while processing your request. Please try again later.

We need a phone number to keep your account secure. We will send you a code to validate your phone number.

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

An error occurred while processing your request. Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

An error occurred while processing your request. Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

An error occurred while processing your request. Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

We have sent an email to {0}. Click the link in the email to finish setting up your dashboard

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

An error occurred while processing your request. Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

An error occurred while processing your request. Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

An error occurred while processing your request. Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

Late-cycle

investing

Investors today face no shortage of challenges, with the signs increasingly suggesting a late-cycle environment. To help navigate these uncertainties, we’ve put together a collection of actionable ideas on how to proactively respond to the market’s most pressing issues.

There’s no shortages of challenges in today’s markets, but that doesn’t mean you need to sit on the sidelines. Below we highlight three investment themes worth considering and some strategies you can use to incorporate them into a diversified portfolio.

With mounting uncertainty in the stock market, consider rotating into offerings that focus on quality in those segments that may be experiencing heightened volatility. Why quality? History's shown that companies with more durable earnings are better equipped to weather an economic downturn.

Pivoting to emphasize high-quality fixed-income positions during this phase may prove prudent. We believe mortgage-backed securities, investment-grade corporates, and diversified tax-exempt offerings are particularly attractive in today's market. With compelling yields across the bond market, now may not be the time to be overexposed to risky assets.

Consider increasing exposure to investments that pursue alternative approaches and offer low correlations to stocks and bonds. There are a number of ways to reduce overall volatility through an allocation to alternatives, and a lower risk profile in turbulent markets is typically a prudent move.

Diversification does not guarantee a profit or eliminate the risk of a loss. Correlation is a statistical measure that describes how investments move in relation to each other, which ranges from –1.0 to 1.0. The closer the number is to 1.0 or –1.0, the more closely the two investments are related.

April 19, 2023

April 4, 2023

March 30, 2023

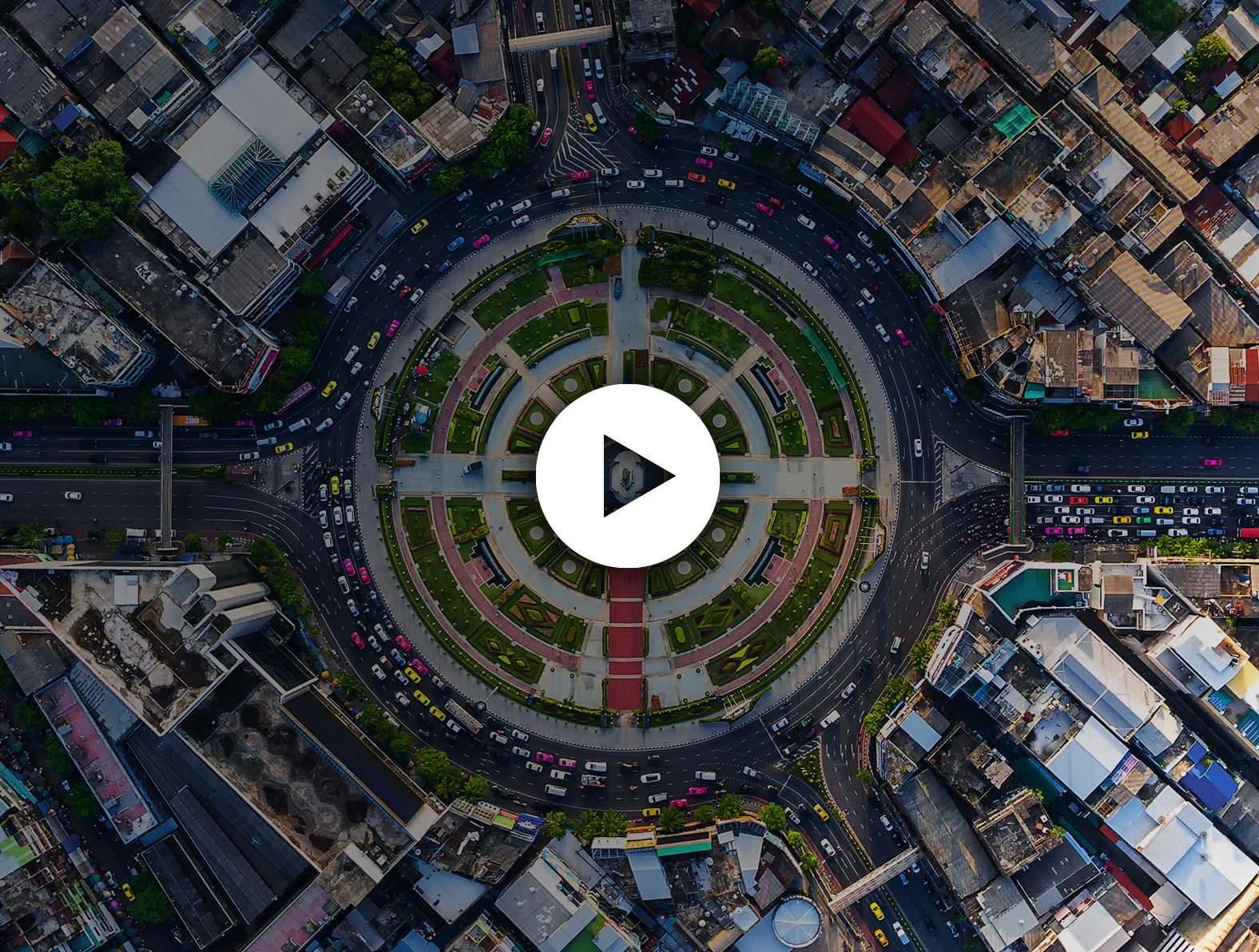

Look no further. Watch this short video to see how we can help you put today's challenges in perspective for your clients.

Understanding where we are in the market cycle—and where we're going—can offer important context and perspective for any investor. Fill out the contact form to request a copy of our interactive market cycle wheel—a useful tool for having those critical conversations about where we are in the cycle.

* indicates a required field

Thank you

Your submission was successful.

MF3070013

JHAN-20230818-1975