Could European credit be an income investor's best-kept secret?

Global investor demand for credit has tended to prioritize the United States over Europe; however, many European credit assets have consistently delivered higher returns with lower volatility than their U.S. counterparts. We believe that there are further relative value opportunities for geographically agnostic, Multi Asset Credit Strategies that can flexibly allocate between the two regions.

Key takeaways

- European credit has consistently outperformed U.S. credit across multiple sub-asset classes over 1-, 3-, 5-, and 10-year periods.¹

- We believe that accessing European credit income within a global, diversified, multi-asset credit portfolio could improve risk-adjusted return potential when using a bottom-up, fundamentally driven research approach.

- Europe is among the most favorable jurisdictions for creditors and income-seeking investors globally, with its protective legal environment, strict directors’ liabilities, and relationship-driven dynamics.²

How does the European credit universe compare against the United States?

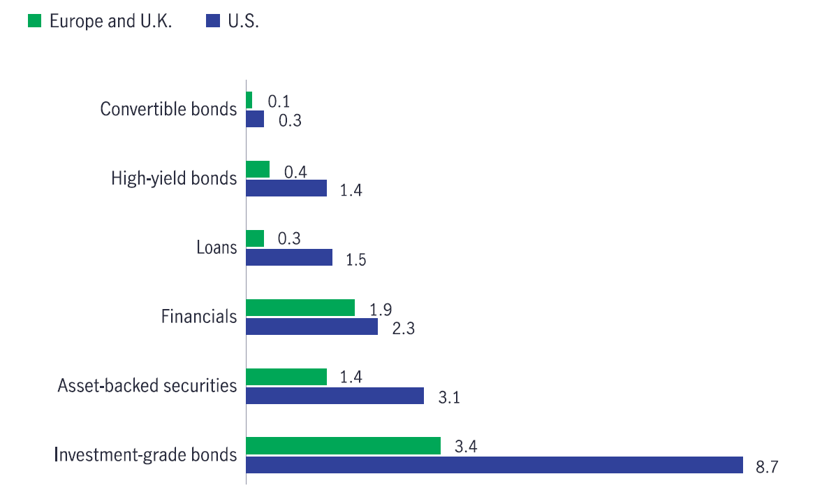

While the United States still has the much larger credit market, Europe has grown significantly over the past decade. At the end of the first quarter of 2025, the value of outstanding European debt within a typical multi-asset credit universe totaled $7.5 trillion. This combined market size has helped to support liquidity, even among many higher-yielding assets.

U.S. and European multi-asset credit universe (US$ trillion)

Although U.S. equities have outperformed European stock markets for more than a decade, home bias hasn’t typically paid off in credit markets; in fact, most types of European credit have outperformed their U.S. counterparts over 1-, 3-, 5-, and 10-year periods.1

Market data shows that European loans have outperformed U.S. loans by 1.2% per year—or 19.5% cumulatively—over 10 years in U.S. dollar-hedged terms; this has compensated investors for their 1.0% higher volatility over the same period. Meanwhile, European high-yield corporate bonds outperformed by 0.6% per year (8.8% cumulatively) with 0.5% a year lower volatility over the same period.3

It’s been a similar story in investment-grade corporate bonds, albeit to a lesser extent, where Europe has outperformed by 0.2% per year (2.9% cumulatively) with 1.9% lower volatility a year.¹

Although U.S. equities have outperformed European stock markets for more than a decade, home bias hasn’t typically paid off for U.S. investors in the credit markets.

For example, based on the previously referenced market data stating that European loans have outperformed U.S. loans by 19.5% on a cumulative basis over the past 10 years, an investor who placed US$10,000 in European loans a decade ago would have earned roughly $1,950 more at the end of those 10 years than if they had invested in U.S. loans. Similarly, using the previously referenced data (8.8% cumulative outperformance), European high-yield corporate bonds would have generated approximately $880 more at the end of the 10-year period compared with their U.S. high-yield counterparts.³ Please note that this is a hypothetical illustration and does not reflect actual trading activity. Past performance is not indicative of future results.

We believe this can be explained by a combination of higher spreads within alternative credit asset classes, better structural protection for creditors, and an institutional buyer base that has a longer-term investment horizon, which tends to have less sensitivity to short-term market movements.

European outperformance

Yearly relative return: Europe vs. U.S. (%)

Europe's favorable structural and legal characteristics

We would argue that one underlying reason for Europe’s attractive risk-adjusted return potential going forward is that its jurisdictions are among the most creditor friendly globally, with their legal frameworks and cultural norms playing a role in creating a consistently supportive environment for lenders.

Less aggressive restructuring tactics

Outside of Europe, an increasingly common practice among sub-investment-grade borrowers is to initiate liability management exercises (LMEs). These exercises effectively enable borrowers to unofficially restructure their debts, usually at the expense of existing lenders. LMEs aren’t a typical feature of European markets—there have been notable cases of judges ruling in favor of the original creditors in attempted LMEs in Europe, while the relationship-driven dynamics of European markets mean that borrowers, lenders, and consultants are hesitant to jeopardize potential future deals by using aggressive LME tactics in existing arrangements.2

Incentives to avoid insolvency

Meanwhile, directors’ liabilities can be particularly strict in Europe. This incentivizes directors to avoid insolvency or use otherwise aggressive tactics that would be detrimental to creditors, which in turn can help to support reduced default rates and higher recovery rates.

Does a European bias always make sense?

Although European credit assets have consistently outperformed their U.S. peers, we wouldn’t advocate an automatic bias toward the region, not least because the past can’t reliably predict the future. Instead, we would argue that a flexible, multi-asset credit approach should look to exploit relative value opportunities between each region when potential opportunities present themselves through the market cycle.

"European credit markets continue to grow and adapt, which means the potential opportunity set is constantly evolving."

A good example would be in the loans market, where relative value between the United States and Europe has shifted over time. From 2013 to 2015, European loans offered prospectively higher returns, which came to fruition. This changed gradually toward late 2015, when the United States began to offer better relative value, before reversing once again, with market returns favoring Europe since 2018.

Geographic value shifts over time

Return from loans: Europe vs. U.S. (May 2013–March 2025)

Managing credit risks

While the general characteristics of each market tell one part of the story, we believe that finding attractive risk-adjusted return opportunities within the global credit universe is ultimately driven by fundamental, bottom-up credit research. The breadth of the multi-asset credit universe, from corporate bonds to loans, convertibles, asset-backed securities, and financials, means this requires deep asset class specialization, a repeatable investment process, and an established, on-the-ground presence in both regions to possess the knowledge required to help mitigate credit risks in each market and for each individual borrower.

What's the credit outlook for Europe?

European credit markets continue to grow and adapt, which means the potential opportunity set is constantly evolving. The region still experiences ongoing, negative investor sentiment toward its economic growth prospects; however, as we’ve seen, Europe has consistently benefited from superior relative value and typically better structural protection from a financial perspective—a dynamic that, in our view, will continue.

While the market is already large enough to support high levels of liquidity, its relatively modest size compared with the United States means that even a marginal, sustained increase in investment flows to the region—either through improved sentiment or longer-term changes in asset allocations—may mean that the positive story in European credit continues.

In our view, European credit should appeal to income-focused investors, offering structural advantages, robust growth, and resilient legal frameworks; however, it remains underappreciated, overshadowed by its U.S. counterpart. Yet, those who look deeper may recognize the many benefits the asset class has to offer, hiding in plain sight.

1 Bloomberg, as of 3/31/25. 2 “Europe may swerve rise in creditor-on-creditor violence,” Alternative Credit Investor, 11/1/24. 3 ICE, Morgan Stanley, MCQS, as of 3/31/25.

Important disclosures

Important disclosures

This material is for informational purposes only and is not intended as investment advice or a recommendation to buy or sell any security. Past performance is not indicative of future results. Investing involves risks, including the possible loss of principal. References to specific asset classes, sectors, or markets are for illustrative purposes only and may not be representative of actual investments. All data is as of March 31, 2025, unless otherwise noted.

The Intercontinental Exchange Bank of America (ICE BofA) U.S. Corporate Index tracks the performance of U.S. dollar-denominated investment-grade corporate debt in the U.S. domestic market. The ICE BofA Euro Corporate Index tracks the performance of euro-denominated investment-grade corporate debt publicly issued in the eurobond or euro member domestic markets. The ICE BofA European Currency High Yield Index tracks the performance of euro- and sterling-denominated below investment-grade corporate debt publicly issued in the eurobond, sterling domestic, or euro domestic markets, capping issuer exposure at 3%. The ICE BofA Contingent Capital Index tracks the performance of investment-grade and below investment-grade contingent capital debt publicly issued in the major domestic and eurobond markets. The Morningstar LSTA US Leveraged Loan Index tracks the performance of the market-weighted performance of U.S. dollar-denominated institutional leveraged loan portfolios. The Morningstar European Leveraged Loan Index is a market-value weighted multi-currency index designed to measure the performance of the European leveraged loan market. It is not possible to invest directly in an index. Past performance is not a guarantee of future results.

The views presented are those of the authors(s) and are subject to. No forecasts are guaranteed. This commentary is provided for informational purposes only and is not an endorsement of any security, mutual fund, sector, or index. Past performance does not guarantee future results. Diversification does not guarantee a profit or eliminate the risk of a loss.

This material is for informational purposes only and is not intended to be, nor shall it be interpreted or construed as a recommendation or providing advice, impartial or otherwise. Manulife John Hancock Investments and our representatives and affiliates may receive compensation derived from the sale of and/or from any investment made in our products and services.

Ratings are from Moody’s, if available, and from Standard & Poor's or Fitch, respectively, if not. Securities in the Not rated category have not been rated by a rating agency; however, the subadvisor performs its own credit analysis for many of these securities and assigns comparable ratings that are used for compliance with applicable investment policies. Prior to June 30, 2021, internal ratings provided by the subadvisor were included. Ratings composition will change. Individual bonds are rated by the creditworthiness of their issuers; these ratings do not apply to the fund or its shares. U.S. government and agency obligations are backed by the full faith and credit of the U.S. government. All other bonds are rated on a scale from AAA (extremely strong financial security characteristics) down to CCC and below (having a very high degree of speculative characteristics). “Short-term investments and other,” if applicable, may include fund receivables, payables, and certain derivatives.

The Fund is an “interval fund” and, in order to provide liquidity to shareholders, subject to applicable law, will conduct quarterly repurchase offers of the Fund’s outstanding common shares of beneficial interest (“Common Shares”) at NAV. There is no secondary market for the fund’s shares and none is expected to develop. Investors should consider shares of the fund to be an illiquid investment. The fund’s use of leverage may not be successful and may create additional risks, including the risk of magnified return volatility and the potential for unlimited loss. ABS include interests in pools of debt securities, commercial or consumer loans, or other receivables. The value of these securities depends on many factors, including changes in interest rates, the availability of information concerning the pool and its structure, the credit quality of the underlying assets, the market’s perception of the servicer of the pool, and any credit enhancement provided. In addition, ABS have prepayment risk. Investors could lose all or substantially all of their investment. Convertible securities are subject to certain risks of both equity and debt securities. Fund distributions generally depend on income from underlying investments and may vary or cease altogether in the future. Investing in distressed debt securities is highly speculative and risky, as they often do not generate interest, may not repay principal, and can result in a total loss of the investment. Exposure to credit risk due to the types of investments and loans made by the fund. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Please see the fund’s prospectus for additional risks.

MF5039792