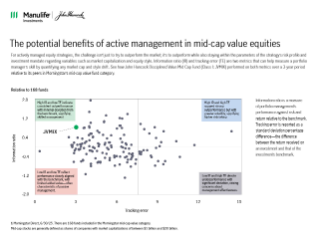

The potential benefits of active management in mid-cap value equities

For actively managed equity strategies, the challenge is to outperform while also staying within the parameters of the strategy’s mandate. This flyer shows how John Hancock Disciplined Value Mid Cap Fund (Class I: JVMIX) has performed as measured by information ratio and tracking error over a 3-year period relative to its peers in Morningstar’s mid-cap value fund category.

Approved for use with investors

Important disclosures

Important disclosures

Information ratio is a measure of portfolio management’s performance against risk and return relative to the benchmark. Tracking error is reported as a standard deviation percentage difference—the difference between the return received on an investment and that of the investment’s benchmark.

The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Value stocks may decline in price. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Large company stocks could fall out of favor, and illiquid securities may be difficult to sell at a price approximating their value. Please see the fund’s prospectus for additional risks.

Accept Terms Of Use

Thank you for requesting the pre-inception information. After you certify that you agree with the statements below, we will provide the relevant documents to you.

You are an institutional investor, a registered investment advisor, or a registered financial advisor as defined by FINRA Rule 2210(a)(4). This information will not be communicated, shared, or distributed to the public, an individual investor, or any person who does not meet FINRA's definition of an institutional investor. No part of this information may be reproduced or transmitted in any form or by any means.

If you have any questions, please call a John Hancock Investment Management representative at 800-225-6020. Thank you for your interest in John Hancock Investment Management.