September 24, 2024

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

Enter your password to login.

To verify your identity, we need to send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

Please try again later.

We need a phone number to keep your account secure. We will send you a code to validate your phone number.

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

We have sent an email to {0}. Click the link in the email to finish setting up your dashboard

Please enter the email address you used when registering.

If you have a valid account with us, you will receive an email with instructions to reset your password.

Please try again later.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Please enter the 6-digit code sent to your email. If you have not received a code, you may not have a registered account.

Please try again later.

Enter your password to login.

In order to change your password, we need to verify your identity. We will send an authorization code to the email address on file.

Enter the 6-digit code sent to your email

Please try again later.

In order to change your phone number, we need to verify your identity. We will send an authorization code to the email address on file.

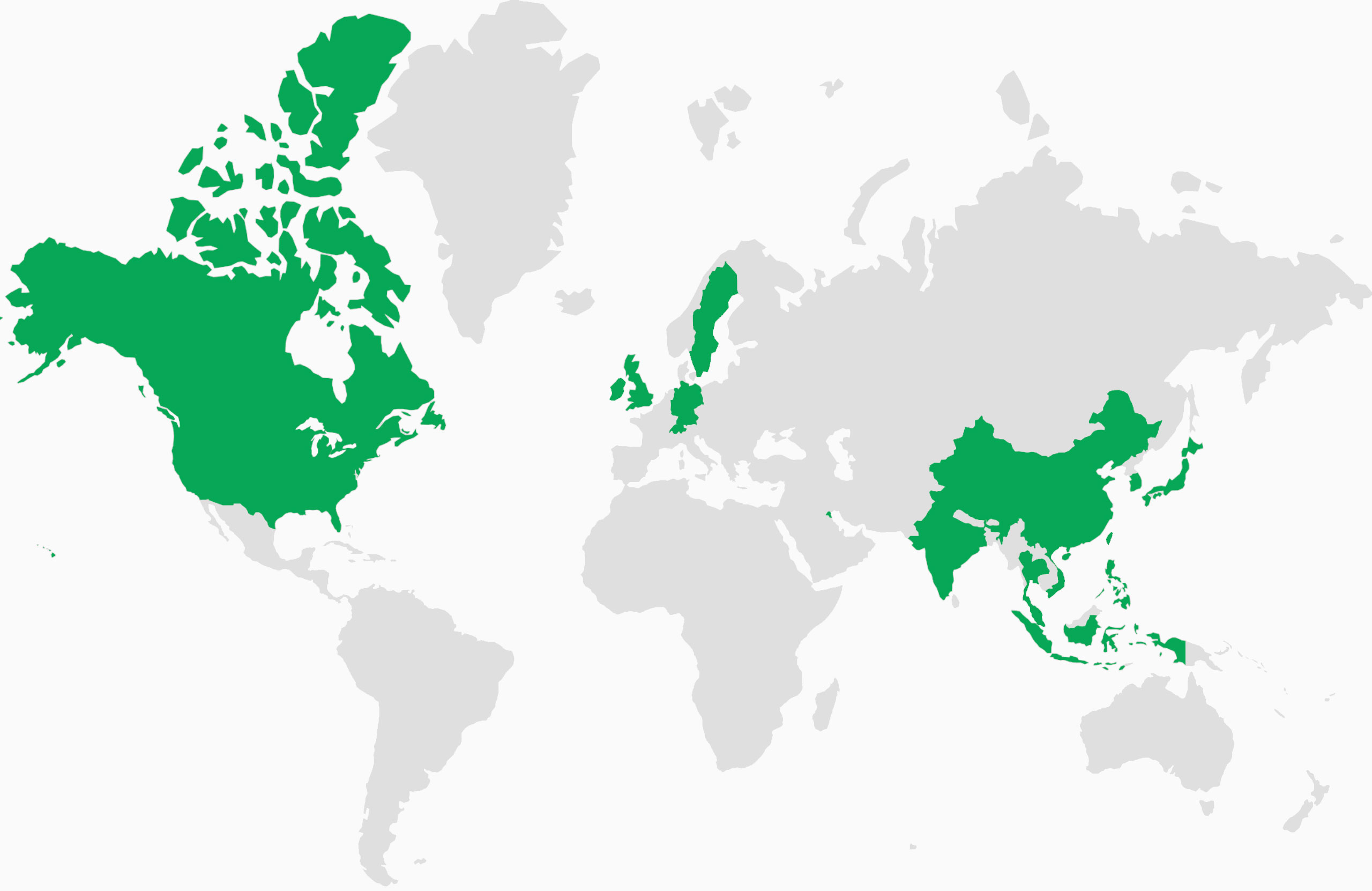

See how our fixed-income lineup combines our in-house capabilities with the specialized expertise of subadvisors from around the world.

For more than a century, our parent company, Manulife, has been helping clients protect and preserve their assets. That heritage of uncompromising risk management is at the core of what Manulife Investment Management’s fixed-income team can offer today. A global footprint, strong centralized resources, a research-driven process, and a culture of collaboration are just some of the hallmarks the autonomous portfolio teams bring to the diverse strategies they oversee. It’s a combination of attributes we believe few firms can match.

Source: Manulife Investment Management statistical package, as of 9/30/25, in USD, unless otherwise noted. Assets under management (AUM) excludes liability-driven investing assets and includes certain fixed-income portions of balanced investments. The methodologies used to compile the total AUM are subject to change. Manulife Investment Management’s global investment professional team includes expertise from several Manulife Investment Management affiliates and joint ventures; not all entities represent all asset classes.

A leading global credit specialist, combining industry-specific micro and macro trend research with rigorous, bottom-up security analysis

Established global credit manager that invests across private and public credit markets through multiple credit cycles

Long-established global asset manager investing across the equity, fixed-income, currency, and commodity markets, including multistrategy, specialty, and alternative investment approaches

Representative list of asset managers. All logos are the property of their respective owners. This is not a complete list of our subadvisors or funds. This material does not constitute investment advice and is for informational purposes only. Please consult your financial professional before making any investment decisions.

Not every investor buys bonds for the same reason. Some are seeking to generate income, others are looking to add stability to their portfolios, and some want a combination of both. Defining your goals when it comes to the role of fixed income in your portfolio can help inform which segments of the bond market are worth an allocation—and which you may want to avoid.

The table below provides yields and other information on our fixed-income funds, along with access to the prospectus for each fund shown. Performance information and expense ratios can be found on our investments listing page.

| John Hancock fund name | Ticker | 30-day SEC yield subsidized | 30-day SEC yield unsubsidized | Distribution yield | Yield to maturity | Yield to worst | Tax-equivalent yield | Effective duration | Average price | Expense ratio (gross) | Expense ratio (net) | Expense ratio (waiver date) | Prospectus |

| Bond Fund Class I | JHBIX | 4.41 | 4.41 | 4.53 | 5.07 | 4.99 | -- | 6.04 | 97.39 | 0.47 | 0.46 | 7/31/27 | Prospectus |

| California Municipal Bond Fund I | JCAFX | 3.94 | 3.79 | 3.90 | 5.01 | 4.73 | 8.58 | 9.42 | 101.91 | 0.72 | 0.57 | 9/30/26 | Prospectus |

| Emerging Markets Debt Fund Class I | JMKIX | 6.03 | 6.02 | 5.75 | 7.49 | 7.47 | -- | 7.36 | 99.40 | 0.89 | 0.88 | 7/31/26 | Prospectus |

| Floating Rate Income Fund Class I | JFIIX | 6.54 | 6.44 | 6.91 | -- | 8.07 | -- | 0.13 | 94.28 | 0.90 | 0.80 | 12/31/26 | Prospectus |

| High Yield Fund Class I | JYHIX | 6.07 | 6.06 | 6.55 | 7.10 | 6.64 | -- | 2.76 | 98.81 | 0.67 | 0.66 | 7/31/27 | Prospectus |

| High Yield Municipal Bond Fund Class I | JHYMX | 5.20 | 5.06 | 5.17 | 6.12 | 5.70 | 8.78 | 8.96 | 94.40 | 0.90 | 0.71 | 9/30/26 | Prospectus |

| Income Fund Class I | JSTIX | 4.69 | 4.68 | 4.50 | 5.24 | 4.91 | -- | 4.84 | 96.90 | 0.54 | 0.53 | 7/31/27 | Prospectus |

| Investment Grade Bond Fund Class I | TIUSX | 4.16 | 4.10 | 4.23 | 4.78 | 4.74 | -- | 6.03 | 96.80 | 0.57 | 0.49 | 9/30/26 | Prospectus |

| Municipal Opportunities Fund Class I | JTBDX | 3.35 | 3.33 | 3.66 | 4.55 | 4.34 | 5.66 | 5.78 | 104.06 | 0.62 | 0.59 | 9/30/26 | Prospectus |

| Opportunistic Fixed Income Fund Class I | JABTX | 3.61 | 3.38 | 4.13 | 4.22 | 4.17 | -- | 6.52 | 82.04 | 1.15 | 0.92 | 12/31/26 | Prospectus |

| Short Duration Bond Fund Class I | JSNIX | 4.18 | 4.17 | 4.93 | 4.75 | 4.41 | -- | 1.88 | 101.54 | 0.39 | 0.38 | 7/31/27 | Prospectus |

| Short Duration Municipal Opportunities Fund Class I | JHSJX | 3.05 | 2.85 | 3.57 | 4.32 | 4.18 | 5.15 | 3.82 | 105.14 | 0.93 | 0.46 | 9/30/26 | Prospectus |

| Strategic Income Opportunities Fund Class I | JIPIX | 4.83 | 4.78 | 3.74 | 5.62 | 5.21 | -- | 4.26 | 92.25 | 0.82 | 0.77 | 12/31/26 | Prospectus |

| John Hancock fund name | Ticker | 30-day SEC yield subsidized | 30-day SEC yield unsubsidized | Distribution yield | Yield to maturity | Yield to worst | Tax-equivalent yield | Effective duration | Average price | Expense ratio (gross) | Expense ratio (net) | Expense ratio (waiver date) | Prospectus |

| Bond Fund Class R6 | JHBSX | 4.52 | 4.51 | 4.64 | 5.07 | 4.99 | -- | 6.04 | 97.39 | 0.36 | 0.35 | 7/31/27 | Prospectus |

| California Municipal Bond Fund R6 | JCSRX | 4.02 | 3.87 | 3.97 | 5.01 | 4.73 | 8.76 | 9.42 | 101.91 | 0.65 | 0.50 | 9/30/26 | Prospectus |

| Emerging Markets Debt Fund Class R6 | JEMIX | 6.11 | 6.10 | 5.86 | 7.49 | 7.47 | -- | 7.36 | 99.40 | 0.78 | 0.77 | 7/31/26 | Prospectus |

| Floating Rate Income Fund Class R6 | JFIRX | 6.66 | 6.55 | 7.02 | -- | 8.07 | -- | 0.13 | 94.28 | 0.79 | 0.69 | 12/31/26 | Prospectus |

| High Yield Fund Class R6 | JFHYX | 6.16 | 6.15 | 6.64 | 7.10 | 6.64 | -- | 2.76 | 98.81 | 0.57 | 0.56 | 7/31/27 | Prospectus |

| High Yield Municipal Bond Fund Class R6 | JCTRX | 5.29 | 5.15 | 5.25 | 6.12 | 5.70 | 8.94 | 8.96 | 94.40 | 0.82 | 0.63 | 9/30/26 | Prospectus |

| Income Fund Class R6 | JSNWX | 4.79 | 4.78 | 4.60 | 5.24 | 4.91 | -- | 4.84 | 96.90 | 0.43 | 0.42 | 7/31/27 | Prospectus |

| Investment Grade Bond Fund Class R6 | JIGEX | 4.26 | 4.20 | 4.34 | 4.78 | 4.74 | -- | 6.03 | 96.80 | 0.46 | 0.38 | 9/30/26 | Prospectus |

| Municipal Opportunities Fund Class R6 | JTMRX | 3.43 | 3.42 | 3.73 | 4.55 | 4.34 | 5.79 | 5.78 | 104.06 | 0.55 | 0.52 | 9/30/26 | Prospectus |

| Opportunistic Fixed Income Fund Class R6 | JABUX | 3.72 | 3.49 | 4.24 | 4.22 | 4.17 | -- | 6.52 | 82.04 | 1.04 | 0.81 | 12/31/26 | Prospectus |

| Short Duration Bond Fund Class R6 | JSNRX | 4.29 | 4.28 | 5.04 | 4.75 | 4.41 | -- | 1.88 | 101.54 | 0.28 | 0.27 | 7/31/27 | Prospectus |

| Short Duration Municipal Opportunities Fund Class R6 | JHSKX | 3.12 | 2.92 | 3.65 | 4.32 | 4.18 | 5.27 | 3.82 | 105.14 | 0.85 | 0.38 | 9/30/26 | Prospectus |

| Strategic Income Opportunities Fund Class R6 | JIPRX | 4.94 | 4.89 | 3.85 | 5.62 | 5.21 | -- | 4.26 | 92.25 | 0.71 | 0.66 | 12/31/26 | Prospectus |

| John Hancock fund name | Ticker | 30-day SEC yield subsidized | 30-day SEC yield unsubsidized | Distribution yield | Yield to maturity | Yield to worst | Tax-equivalent yield | Effective duration | Average price | Expense ratio (gross) | Expense ratio (net) | Expense ratio (waiver date) | Prospectus |

| Corporate Bond ETF | JHCB | 4.82 | 4.68 | 5.04 | 5.33 | 5.11 | -- | 6.77 | 94.35 | 0.53 | 0.29 | 8/31/26 | Prospectus |

| Core Bond ETF | JHCR | 4.61 | 3.82 | 4.69 | 4.71 | 4.69 | -- | 6.08 | 98.05 | 0.65 | 0.29 | 8/31/26 | Prospectus |

| Core Plus Bond ETF | JHCP | 4.68 | 4.52 | 4.82 | 4.99 | 4.90 | -- | 6.03 | 98.20 | 0.56 | 0.36 | 8/31/26 | Prospectus |

| Dynamic Municipal Bond ETF | JHMU | 3.44 | 3.13 | 4.05 | 4.26 | 4.07 | 5.81 | 5.98 | 103.12 | 1.01 | 0.39 | 8/31/26 | Prospectus |

| High Yield ETF | JHHY | 6.31 | 6.19 | 7.27 | 7.25 | 6.93 | -- | 3.28 | 98.10 | 1.03 | 0.52 | 8/31/26 | Prospectus |

| Mortgage-Backed Securities ETF | JHMB | 4.74 | 4.67 | 4.57 | 4.96 | 4.96 | -- | 5.61 | 94.39 | 0.60 | 0.39 | 8/31/26 | Prospectus |

| Preferred Income ETF | JHPI | 5.87 | 5.78 | 5.85 | 6.74 | 6.33 | -- | 4.64 | 74.38 | 0.85 | 0.54 | 8/31/26 | Prospectus |

© 2026 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Diversification does not guarantee a profit or eliminate the risk of a loss.

Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. Mortgage- and asset-backed securities may be sensitive to changes in interest rates and may be subject to early repayment and the market's perception of issuer creditworthiness. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Hedging and other strategic transactions may increase volatility and result in losses if not successful. Distributions generally depend on income from underlying investments and may vary or cease altogether in the future. Please see the funds' prospectuses for additional risks.

A fund's ESG policy could cause it to perform differently than similar funds that do not have such a policy.

The performance data shown represents past performance, which does not guarantee future results. Investment returns and principal value will fluctuate, so that Investors' shares, when sold, may be worth more or less than their original cost. Performance figures assume that all distributions are reinvested. Performance for other share classes will vary. For complete information, including expense ratio and monthly performance, please click on the respective fund links above.

The performance data shown represents past performance, which does not guarantee future results. Investment returns and principal value will fluctuate, so that Investors' shares, when sold, may be worth more or less than their original cost. Performance figures assume that all distributions are reinvested. Performance for other share classes will vary. For complete information, including expense ratio and monthly performance, please click on the respective fund links above.

The performance data shown represents past performance, which does not guarantee future results. Investment returns and principal value will fluctuate, so that Investors' shares, when sold, may be worth more or less than their original cost. Performance figures assume that all distributions are reinvested. Performance for other share classes will vary. For complete information, including expense ratio and monthly performance, please click on the respective fund links above.

Market price and performance is calculated as follows: (i) for the time periods starting October 3, 2022, the NYSE Arca’s Official Closing Price or, if it more accurately reflects market price at the time as of which NAV is calculated, the bid/ask midpoint as of that time and (ii) for time periods preceding October 3, 2022, the bid/ask midpoint at 4 P.M., Eastern time, when the NAV is typically calculated; your returns may differ if you traded shares at other times. NAV is calculated by dividing the total value of all the securities in the fund's portfolio plus cash, interest, and receivables, minus any liabilities, by the number of fund shares outstanding.

September 24, 2024

May 3, 2024

Financial professionals: Request a complimentary analysis of your fixed-income allocations to ensure you’re positioned appropriately for today’s market. Together, we’ll conduct a:

After the audit is generated, a Manulife John Hancock Investments representative will contact you to discuss the results and answer any questions.

* indicates a required field

Thank you

Your submission was successful