Why strong ESG practices can offer companies a competitive advantage

Sustainable investing was once considered a niche corner of the investment universe, a way for investors to align their portfolios with their personal values. But today, the reality is that corporate performance, investment performance, and ESG issues are inextricably linked.

As the longest-standing environmental, social, and governance (ESG)-only firm in the United States, we believe that being a shareholder carries the responsibility of actively engaging portfolio companies in a range of ESG issues. In doing so, we encourage companies to take positive and effective environmental and social actions that are consistent with shareholder interests. Perhaps most important for investors, studies have shown that operational and stock price performance of companies may be positively influenced by good sustainability and ESG practices.

The financial impact of ESG advocacy

We believe companies that incorporate ESG factors into their long-term strategic planning—and communicate that fact to investors—provide a more complete picture of their prospective value. Financial performance is one area that's received substantial, if not the most, attention in research on ESG issues. A recent report analyzed approximately 200 studies to assess how sustainable corporate practices have affected investment returns, and these studies have shown that operational and stock price performance of companies may be positively influenced by good sustainability and ESG practices.1

According to one report, solid ESG practices resulted in better operational performance in 88% of companies, the stock price performance of 80% of companies was positively influenced by good sustainability practices and lowered the cost of capital of 90% of companies, and companies with strong sustainability scores showed better operational performance and were less of an investment risk.

The impact of advocacy on ESG investing

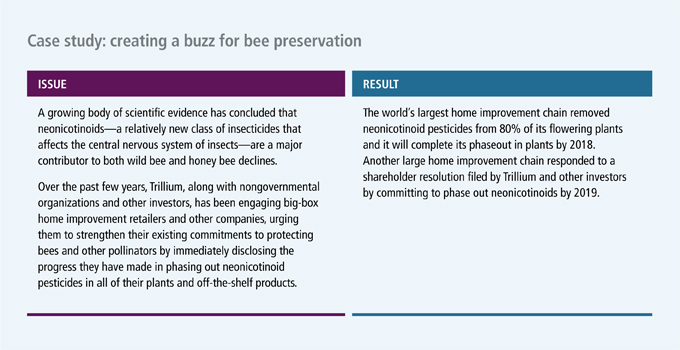

For over 30 years, the ESG community has achieved a number of major successes in building this awareness and in bringing about change. At Trillium, we directly engage with companies, encouraging them to take positive and effective ESG actions that are consistent with shareholder interests, and we've affected many issues through our ESG advocacy.

Environmental factors

We've pushed companies to improve on a variety of environmental issues through our advocacy work, including setting reduction goals for greenhouse gas emissions, reducing fugitive methane emissions, setting renewable energy purchasing targets, and reducing exposure to toxic chemicals. For more than a decade, Trillium has pressed companies to track and report their direct impact on climate change. Our shareholder proposals and dialogue over the years have led to the development of strategic plans on climate change and agriculture, as well as the reduction of climate footprints and climate risk exposure for certain companies.

Social factors

We've engaged with companies on a wide range of social issues, including gender pay equity, diversity data disclosure, improving supply chain human rights policies, and LGBT equality in the workplace. In 2012, we began engaging portfolio companies with all-male boards and those lagging their peers on diversity. To date, seven companies have appointed women to their boards following our engagements, and another eight have committed to include gender and racial diversity among the qualities they seek in board members. Trillium also views diversity, inclusive of gender and race, as a critical attribute to a well-functioning organization, and our engagement has helped move dozens of Fortune 500 corporations to implement gender identity, gender expression, and sexual orientation nondiscrimination policies.

Governance factors

We've worked to improve corporate behavior in key aspects of corporate governance, including corporate responsibility data disclosure, political contribution transparency, and board diversity. How corporate boards of directors oversee corporate political and lobbying spending has become increasingly important in the past 10 years. Also, with the help of the Center for Political Accountability, we've filed shareholder proposals at dozens of companies and have successfully persuaded approximately two dozen companies to significantly improve their spending transparency, including companies in the energy, transportation, healthcare, financial services, retail, and manufacturing industries.

Fostering a collaborative environment

For nearly four decades, the ESG community has achieved a number of major successes in building awareness and in bringing about change. Going forward, we believe that collaboration between investors, companies, and communities can accelerate the widespread acceptance of sustainable business practices while also having a positive effect on investment returns.

1 “From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance,” University of Oxford, Arabesque Partners, March 2015.

Important disclosures

Large company stocks could fall out of favor. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. A portfolio concentrated in one sector or that holds a limited number of securities may fluctuate more than a diversified portfolio. Hedging and other strategic transactions may increase volatility and result in losses if not successful. Illiquid securities may be difficult to sell at a price approximating their value. The fund's ESG policy could cause it to perform differently than similar funds that do not have such a policy.

MF307804