ESG investing is a better way to know your borrowers

The remarkable growth of environmental, social, and governance (ESG) investing in recent years has been driven in no small part by investors' desire to better align their portfolios with their personal values.

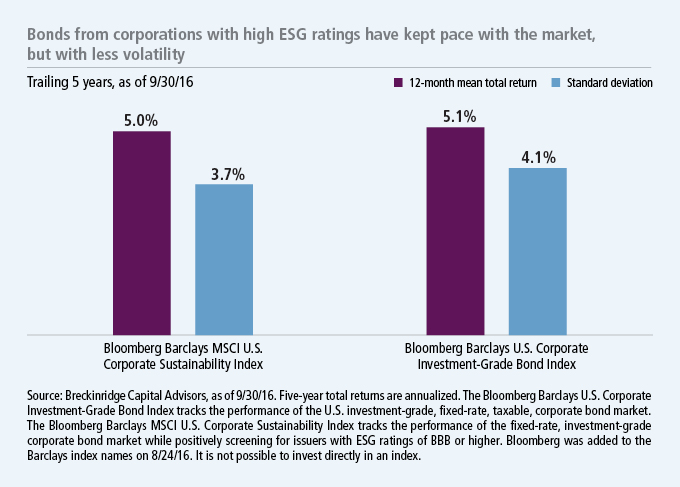

ESG investing is one means to that end: Tilting a traditional portfolio in favor of companies and organizations that are engaged in environmentally and socially conscious practices helps to directly encourage sustainable, responsible corporate and government behavior. But ESG investing is far more than a values-oriented investment style. Sustainable investing, we believe, represents a more holistic approach to credit analysis: It requires deeper research than traditional investment analysis and looks to uncover unidentified vulnerabilities that may affect the present and future value of a bond. Examining ESG criteria adds a new level of rigor not only by seeking to realistically assess the reliability of future cash flows, the ability of a borrower to repay, and the price of a bond, but also by rewarding practices that focus on long-term viability through lower costs, less waste, and greater efficiencies. The analysis of these ESG factors is fully integrated with and additive to our fundamental credit analysis, a process we formalized by creating our own methodologies—for both municipals and corporates—to assess sustainability.

Corporate bonds: helping to avoid the costs of unexpected disaster

In the corporate world, event risk and credit distress can unfold in an instant. Breckinridge Capital Advisors closely examines corporate bond issuers across a range of fundamental and ESG metrics, seeking to uncover the potential seeds of sudden deterioration.

- Regulatory and environmental risk. Increasingly strong market reactions to scandals and catastrophes, as well as tightening regulations across a range of issues—from carbon emission standards to privacy laws—show that long-ignored externalities are now having a greater impact on companies and their investors.

- Controversy risk. Class action lawsuits and workplace disasters show what can happen when corporations fail to respect fair labor practices, supply chains, and the interests of other stakeholders—with serious consequences for an issuer's bond prices. By contrast, the best performers seize opportunities to engage their employees and invest in human capital as well as in their communities.

- Management risk. Wasteful executive pay and fiscal gimmickry are often signs of poor oversight. Well-governed organizations follow sound practices such as independent board audits and transparent disclosure of both financial and nonfinancial (e.g., ESG) factors.

Municipal bonds: investing in sustainable projects and fiscally sustainable issuers

In analyzing the sustainability of municipal bond issues, Breckinridge asks a number of questions designed to uncover potential risks:

- Is the project essential? The more vital a project is to a local community, the more likely bondholders will be repaid. During the Great Depression, a time of obvious financial distress for municipal bond issuers, bonds issued for school construction and water and sewer systems recorded some of the lowest default rates.1

- Does the issuer support its social and economic environment? A municipality that invests in its schools and environment may strengthen its community fabric over time, especially if these actions improve the local employment rate, household incomes, and constituent education levels.

- Are governance practices sound? Well-managed municipalities look beyond upcoming budgets in order to avoid future destabilizing events. They adhere to strong financial controls, develop affordable capital plans, and closely monitor long-term pension liabilities and principal maturities.

A comprehensive framework for sustainable investing

At Breckinridge, by examining a wide range of material ESG factors, we aim to identify and invest in the best bonds in the market. In the corporate bond market, we invest in companies that are improving efficiencies, reducing waste, engaging relevant stakeholders, and holding management accountable for performance. In the municipal sector, we look for essential projects undertaken by fiscally sound, forward-thinking municipalities. We evaluate ability to pay, security structures that protect bondholders, and taxpayer willingness to pay as measured by a project's focus on health, education, or other core government missions. The result, we believe, isn't just a portfolio built for positive impact, but one that incorporates a more comprehensive analysis of fixed-income issuers' risks and opportunities.

1 Municipal Bonds: A Century of Experience, Albert Hillhouse, 1936.

Important disclosures

Diversification does not guarantee a profit or eliminate the risk of a loss.

Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Mortgage- and asset-backed securities may be sensitive to changes in interest rates and may be subject to early repayment and the market's perception of issuer creditworthiness. Municipal bond prices can decline due to fiscal mismanagement or tax shortfalls, or if related projects become unprofitable. The interest earned on taxable municipal securities is fully taxable at the federal level and may be taxed at the state level. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. A fund's ESG policy could cause it to perform differently than similar funds that do not have such a policy.

MF335659