Sample tax forms

View sample tax forms and documents, instructions for filing, and the approximate mailing dates for each.

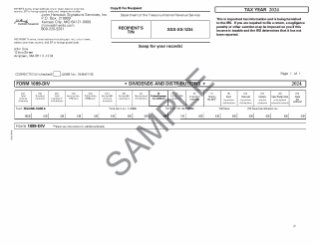

Sample Form 1099-DIV

This piece is an example of Form 1099-DIV along with instructions for tax filing.

Approved for use with investors

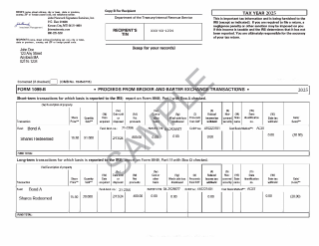

Sample Form 1099-B

This piece is an example of Form 1099-B along with instructions for tax filing.

Approved for use with investors

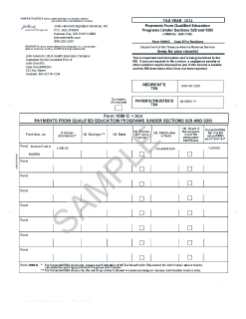

Sample Form 1099-Q

This piece is an example of Form 1099-Q along with instructions for tax filing.

Approved for use with investors

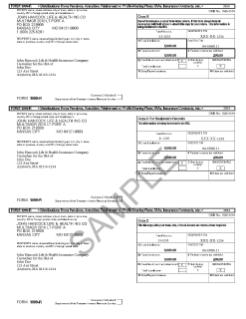

Sample Form 1099-R

This piece is an example of Form 1099-R along with instructions for tax filing.

Approved for use with investors

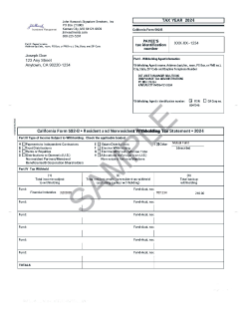

Sample California Form 592-B

This piece is an example of California Form 592-B, along with instructions for tax filing.

Approved for use with investors

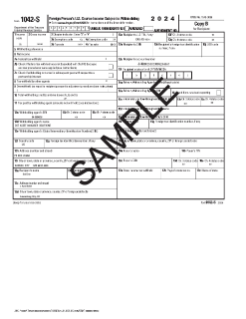

Sample Form 1042-S

This piece is an example of Form 1042-S, along with instructions for tax filing.

Approved for use with investors

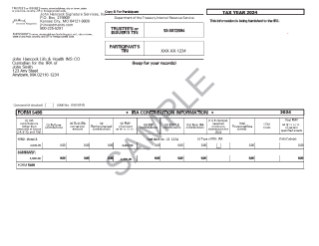

Sample Form 5498

This piece is an example of Form 5498, along with instructions for tax filing.

Approved for use with investors

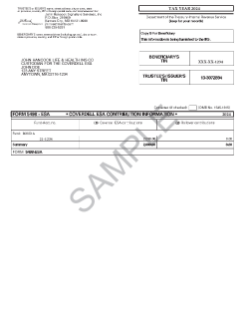

Sample Form 5498-ESA

This piece is an example of Form 5498-ESA, along with instructions for tax filing.

Approved for use with investors