ESG funds are designed to help you

Pursue high risk-adjusted returns relative to traditional investments, while supporting companies with strong governance that are making a positive impact on the environment and society.

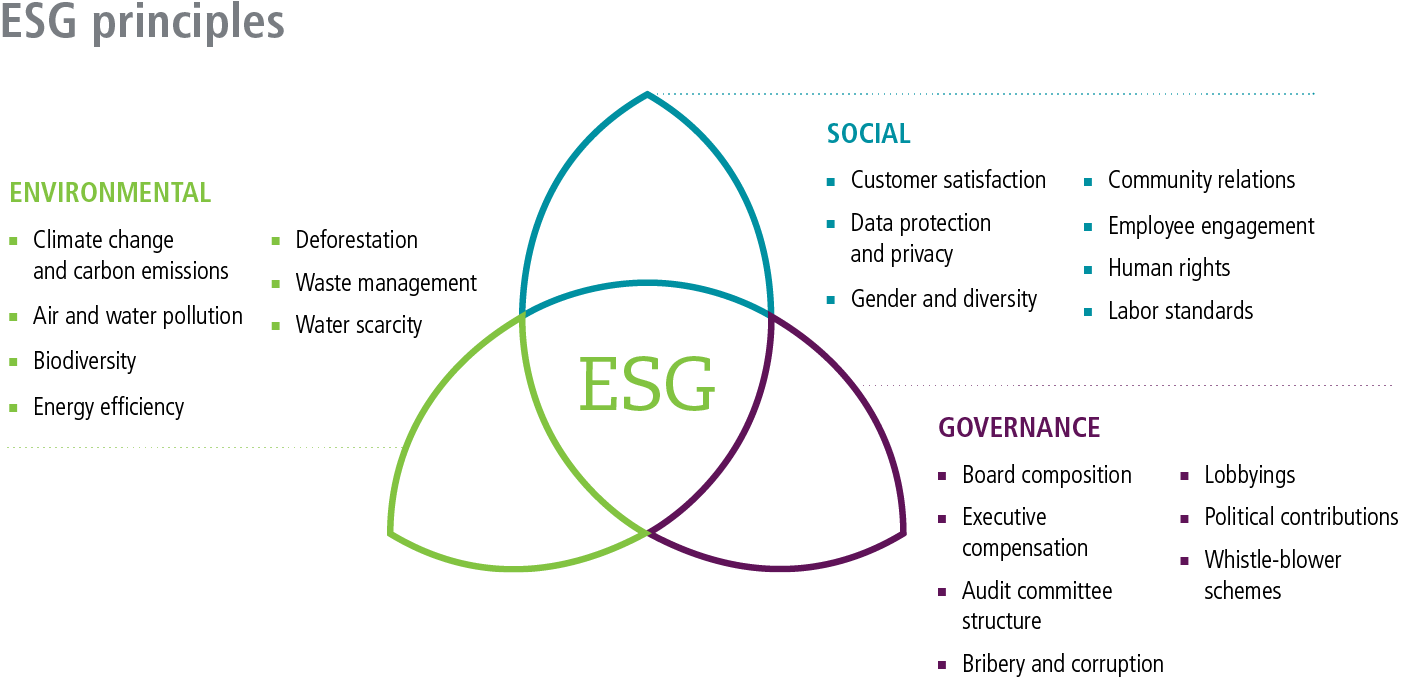

ESG principles are reshaping investing today

ESG investing has reached a tipping point since its early days. Today’s ESG funds analyze both financial and nonfinancial aspects of a company to get a better understanding of their overall risk and impact. Many take it one step further by using their voting power as corporate shareholders or working directly with company management to advocate for change across a wide range of issues.

Making an impact in the world

Percentage of individual and institutional investors consider a company’s social and environmental impact important to their investment decisions.

Important disclosures

Advancing environmental, social, and governance investing,” Deloitte, 2020.

By rewarding companies that score well on ESG issues or by engaging directly through corporate activism, investors have helped shape corporate behavior worldwide. One testament to the growing impact of ESG investing is the creation of Principles for Responsible Investment, a leading proponent of ESG investing, with nearly 5,400 signatories worldwide representing roughly $121 trillion in invested assets.1

Important disclosures

1 Principles for Responsible Investment, September 2023.

Different ways to make a difference

From traditional investing to philanthropy, investors have a variety of ways to make a difference and balance the goals of investment returns with social impact.

| Traditional investing | Limited or no focus on ESG factors |

| Negative screening | Exclusionary investment practice designed to screen out companies that offer harmful products or services (e.g., weapons, tobacco, alcohol, and gambling) |

| ESG integration | The combination of ESG factors with traditional securities analysis, ESG integration moves beyond negative screening by adding a disciplined assessment of a broad set of nonfinancial issues that affect company valuations |

| Shareholder advocacy | Employing the influence of one’s status as a corporate shareholder to engage directly with companies’ management or to affect change through proxy initiatives and/or direct dialog |

| Impact/community investing | Investments constructed with positive impact as the primary objective and financial returns as a secondary goal, they span the spectrum of asset classes and vehicles, such as publicly traded equities, fixed-income instruments, and private investments |

| Philanthropy | The act of deploying financial resources for the good of society, community, the environment, and/or other causes with no regard for financial return |

Making a difference in your portfolio

In addition to helping support companies with strong governance that are making a positive impact on the environment and society, a balanced ESG portfolio would have generated a higher absolute return and a higher risk-adjusted return—as measured by Sharpe ratio—as well as less volatility than a similar portfolio using traditional investments.

Hypothetical $100,000 investment in two balanced portfolios

3/1/19-3/31/24

Important disclosures

Source: Morningstar Direct, as of 3/31/24. This chart is for illustration purposes only and does not reflect the performance of any John Hancock fund. In the traditional balanced portfolio, U.S. equities, international equities, and core bonds are represented by the S&P 500 Index, which tracks the performance of 500 of the largest publicly traded companies in the United States; the MSCI World ex-USA Index, which tracks the performance of publicly traded large- and mid-cap stocks of developed-market companies outside the United States; and the Bloomberg Barclays U.S. Aggregate Bond Index, which tracks the performance of U.S. investment-grade bonds in government, asset-backed, and corporate debt markets, respectively. In the balanced ESG portfolio, U.S. equities, international equities, and core bonds are represented by the MSCI KLD 400 Social Index, which tracks the performance of 400 U.S. companies with outstanding environmental, social, and governance (ESG) ratings and excludes companies whose products have negative social or environmental impacts; the MSCI All Country (AC) World ESG Index, which tracks the performance of publicly traded large- and mid-cap stocks of companies with high ESG performance relative to their sector peers in 23 developed markets and 24 emerging markets; and the Bloomberg Barclays MSCI U.S. Aggregate ESG Weighted Index, which tracks the performance of U.S. investment-grade bonds in government, asset-backed, and corporate debt markets, overweighting issuers that have higher ESG ratings and/or positive ratings momentum while underweighting issuers that have lower ratings and/or negative momentum, respectively. It is not possible to invest directly in an index. Sharpe ratio is a measure of excess return per unit of risk, as defined by standard deviation. A higher Sharpe ratio suggests better risk-adjusted performance. Standard deviation is a statistical measure of the historic volatility of a portfolio. It measures the fluctuation of a fund’s periodic returns from the mean or average. The larger the deviation, the larger the standard deviation and the higher the risk. Past performance does not guarantee future results.

Finding the best specialized manager for every fund we offer

As a company of Manulife Investment Management, we’re part of an organization with a commitment to sustainability. In addition, our ESG lineup includes funds managed by three ESG specialist firms with proven track records of combining financial returns with positive impact.

John Hancock ESG Funds

| Fund | Morningstar category | Use for |

|---|---|---|

| Morningstar category Intermediate Core Bond | Use for Opportunistic fixed-income holding | |

| Morningstar category Foreign Large Blend | Use for Opportunistic international holding | |

| Morningstar category Large Blend | Use for Opportunistic equity holding |

Large company stocks could fall out of favor. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies. Foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability. A portfolio concentrated in one sector or that holds a limited number of securities may fluctuate more than a diversified portfolio. Hedging and other strategic transactions may increase volatility and result in losses if not successful. Illiquid securities may be difficult to sell at a price approximating their value. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if an issuer is unable or unwilling to make principal or interest payments. Mortgage- and asset-backed securities may be sensitive to changes in interest rates and may be subject to early repayment and the market’s perception of issuer creditworthiness. Municipal bond prices can decline due to fiscal mismanagement or tax shortfalls, or if related projects become unprofitable. The interest earned on taxable municipal securities is fully taxable at the federal level and may be taxed at the state level. Liquidity—the extent to which a security may be sold or a derivative position closed without negatively affecting its market value, if at all—may be impaired by reduced trading volume, heightened volatility, rising interest rates, and other market conditions. Fund distributions generally depend on income from underlying investments and may vary or cease altogether in the future. A fund’s ESG policy could cause it to perform differently than similar funds that do not have such a policy. Please see the funds’ prospectuses for additional risks.

Learn more

Investors: Ask your financial professional how adding ESG funds to your portfolio can help you combine financial returns with positive impact.

Advisors: Discover why adding ESG funds to your practice can help you attract and retain the next generation of clients.

Request a meeting with a John Hancock Investment Management Business Consultant

* indicates a required field

Thank you

Your submission was successful